Want to keep track of your finances? I recommend Personal Capital. It’s more than just an expense tracker. It will help you set up a budget and keep track of your retirement portfolio and other investments too. Sign up for Personal Capital now and get an instant $20 bonus when you link an account!

Welcome to the Wealthy Nickel Extra Income Report! Each month, I share all the different ways we make extra income outside the 9-5 job.

For a little background, I decided to share my side hustle income for a few reasons:

- To show you exactly how I make extra money while working a full time job

- To keep me accountable to my goals, and

- To inspire you to start your own money-making ventures on the side.

My family lives on a single income, and we are blessed that that income is enough to pay the bills and put food on the table. But we decided several years ago that we wanted to pursue financial independence and be able to “retire” (whatever that means) long before we hit 65.

In order to do that, we needed to supercharge our savings, which was not going to happen on a single income. We needed to figure out how to make additional income. And with 2 young kids we needed something that didn’t require a huge time commitment. Hence our first side hustle (real estate rentals) was born.

Since then, we’ve tried lots of different side hustles. As we experiment with new ideas, I will share our strategies here. None of this is rocket science, but my hope is you will be able to learn from our extra income projects and apply what you learn to your own projects.

There are a million different ways you can earn extra income on the side, and I certainly haven’t tried everything. There are a lot of good ideas out there that may be a better fit for you. If you want to get some more ideas, I have a Side Hustle Interview Series that documents creative ways others are making money on the side.

With that out of the way, let’s get to this month’s income report!

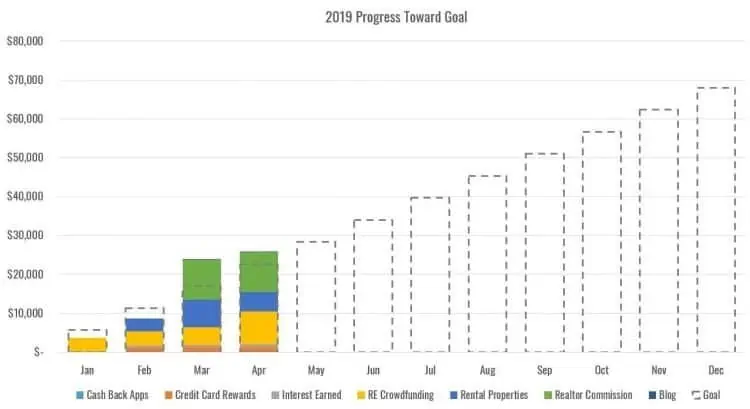

EXTRA INCOME GOALS FOR 2019

While we made over $100k in 2018 from side hustles and passive income, I don’t think that’s a realistic goal for 2019. Almost half of that income came from a flip and wholesale deal we did, and we made the decision to ramp down our flipping business while we have very young kids.

Since we’ve been making moves with our real estate portfolio to make it more passive, I do believe our real estate crowdfunding cash flow should increase this year to make up for some of our lost active income.

- Cash Back Apps: $500

- I started looking for the best cash back apps in September of last year, and think between my wife and I we can make $500 per year with minimal effort.

- Credit Card Rewards: $1,000

- It’s time to sign up for another couple of rewards credit cards this year. If we can get 2 cards with a $500 bonus each, we’ll knock this one out easily.

- Interest Earned: $1,000

- Since selling off some of our real estate, we’ve slowly been moving money into crowdfunding or other investments. But we have a decent amount of cash laying around. I’m currently earning 2.2% at Ally Bank right now, but need to switch over to CIT Bank as they are paying 2.4%!

- Realtor Commissions: $15,000

- My wife has been able to make $15-20k the last few years just from random friends and family transactions. There’s no business in the pipeline, and we don’t do any marketing, but something usually pans out throughout the year.

- Real Estate Crowdfunding: $25,000

- We have a significant chunk of money in real estate crowdfunding and other private equity deals. Some send us a monthly or quarterly check, while others won’t pay us a dime for 5 years or more. Based on the types of deals we’re in, I think we should be able to get $25k in passive cash flow delivered to our mailbox in 2019 🙂

- Rental Properties: $25,000

- We don’t have any big plans to buy or sell any rental properties this year. My goal is to make $300 cash flow per month for each of our 7 units, which comes out to just over $25k.

- Blogging: $500

- Right now blogging is a fun hobby that has cost me a few hundred dollars so far. I’m hoping in 2019 I’ll be able to turn a small profit. We’ll see!

- Total Extra Income Goal: $68,000

Most of our extra income relies on real estate, which is very lumpy. But on average, our goal is to make $5,667 per month.

MONTHLY EXTRA INCOME REPORT

- Cash Back Apps

- This Month: $23

- Year to Date: $206

- Credit Card Rewards

- This Month: $0

- Year to Date: $1,000

- Interest Earned

- This Month: $140

- Year to Date: $829

- Realtor Commissions

- This Month: $0

- Year to Date: $10,191

- Real Estate Crowdfunding

- This Month: $3,944

- Year to Date: $8,424

- Rental Properties

- This Month: -$2,178

- Year to Date: $5,022

- Blogging

- This Month: $71

- Year to Date: $286

- Total Extra Income: $2,000

In total, we made $2,000 this month. We were flying high last month by bringing in over $15,000 in extra income, so this month feels like the plane is in a nosedive.

Our side hustle income is generally very lumpy and depends heavily on when my wife pulls in a real estate commission check, or if we have a big repair bill on a rental property. This month we had a tenant move out and the house required fairly extensive renovation before placing a new tenant, plus we had an unexpected surprise at another rental.

RELATED: How We Got Started on our Side Hustle Journey

PROGRESS TOWARD ANNUAL EXTRA INCOME GOAL

Even though April was not a great month, we are still slightly ahead of our goal with $25,958 in extra income so far this year.

The main drivers are my wife’s realtor income and our passive crowdfunding investments. Our rental properties need to get in line and start producing income this year!

FLIP PROPERTY UPDATE

Last month I talked about how we closed on a property we’d had under contract for 2 years (!!!)

After reviewing contractor bids, our partners and us decided to see if we could sell it off-market to another investor at a price we liked and avoid the renovation, sale, and all the risk that entails. We ended up getting it under contract as-is, and it is set to close in the next few weeks!

While I’m sad that we won’t get to renovate it and make an ugly house pretty again, it makes a lot of sense from a numbers standpoint. If everything goes as planned, I will share the details of how much we put into it and what it sold for next month.

CASH BACK APPS – $23

I have a goal to make an extra $500 per year from cash back apps. $500 per year breaks down to about $42 per month, so we under-performed a bit in April. However, there are a couple big rewards I am waiting on, mostly from Drop.

If there is one app I’d recommend to anyone in the personal finance space, it’s Drop. I’ve found that Drop consistently has finance-related offers that pay you $10-50 just to sign up and participate in a free app of some kind.

A couple months ago, I got $15 for joining Twine – a savings app for couples. And this month I set up a free account with SoFi Wealth and deposited $100. Per the terms, as long as I leave the account open for 90 days I’ll make $50, which is a 200% annualized return on my money!

The beauty of cash back apps is that they require almost zero work. It’s basically free money if you do any shopping with credit cards, and the cash back stacks on top of your credit card rewards. In this day and age, between credit card rewards and cash back apps, you should be able to make at least 3-5% back on every purchase you make.

I have downloaded dozens of cash back apps in search of the ones that pay out the most money for the least amount of work. Once I determine which ones work best, I get my wife to sign up (using my referral code of course for an extra $5-10 bonus). Since my wife does most of the day to day shopping and online purchases for our family, she’s really the one making most of the money.

RELATED: The Only 2 Sites You Need to Make $100 A Month Taking Online Surveys

As of April 2019, here are the apps on my phone:

1. Drop

Drop is one of my favorite apps because it doesn’t require me to do anything at all. I just downloaded the app and linked my credit card. Now when I make purchases on my credit card, it automatically adds points to my account.

If you want to try it out you can sign up here and get a $5 bonus when you link your credit card (that is an affiliate link – I get a small commission if you join that helps keep the lights on around here).

2. Dosh

Dosh is very similar to Drop – once you link a credit card you don’t have to do anything else but collect your cash. Where Drop let’s you earn cash back at a set of specific stores that you choose, Dosh gives you cash back at wider range of stores. I’ve noticed that Dosh tends to have a lot of local restaurants in its list (usually with 5% cash back).

You can sign up to try Dosh through this link and get a $5 bonus (again, that’s my affiliate link).

3. Ebates

Where Drop and Dosh give you cash back for local shopping, Ebates is all about online shopping. If you’re like my family, we buy everything we can online, and Ebates helps us save 2-5% on almost every purchase.

Ebates is probably the most well-known app on my list, and for good reason. It has relationships with a huge number of retailers, so you can get cash back for almost anything you buy online.

Ebates is currently giving out a $10 bonus when you spend $25 if you sign up through this link. (That’s my referral link. I get a small bonus in my Ebates account when you get a bonus.)

4. Ibotta

I am on the fence with Ibotta. I think it’s a great app to save money on groceries, and lots of people who use it rave about it. You can get cash back at almost every grocery store imaginable by selecting offers in the app on various products you buy on a weekly basis.

Unfortunately, we do most of our grocery shopping at Aldi’s, which is pretty much the ONLY grocery store not affiliated with Ibotta. (But don’t feel too bad for me, Aldi’s is the best thing that’s ever happened to our grocery budget). We still do a little shopping at “normal” grocery stores, so it’s worth keeping on my phone for now.

I do heartily recommend the app to anyone who shops at a grocery store other than Aldi’s. Ibotta advertises that their average user saves $20 per month ($240 per year) for a few minutes of work each week.

If you want to give it a try, you can get a $10 bonus when you start shopping with Ibotta here. (Like Ebates, I get a small bonus in my Ibotta account when you get your bonus.)

Get the 4 Apps I Use and a $30 Cash Bonus When You Sign Up Now!

CREDIT CARD REWARDS – $0

Last year, I decided to report the income when we actually cashed out the reward points. I am rethinking that, and may report the income when we receive the rewards. Most of our rewards are Chase Ultimate Rewards Points, which we can generally get a redemption rate of 1.5:1 on when we book travel, but I would just value them at a purely cash value of 100 points to $1.

Nothing to report for credit card rewards in April. We have a pretty good sized bank of Chase points stored up for future travel. We are planning a trip this summer, and trying to decide whether to fly or drive. If we fly, tickets are almost $500 each for a relatively short domestic flight, which is crazy to me. I need to look into credit card sign-up bonuses and get started on applying. If we take this trip it will definitely deplete our points.

We add about 3-4,000 points ($30-40) a month just from our normal credit card use, mainly on our Chase cards. We’ve got a balance of about 120,000 points right now, which at our average redemption rate of 1.5:1 is worth $1,800 toward travel costs. We try to open a couple new cards per year to get the sign-up bonuses. I don’t have the next one planned, so I need to get on that!

I absolutely love credit card rewards, as we haven’t paid for a plane ticket in almost 3 years now. I need to write a post about our strategy, but you can find lots of info online just by googling “travel reward hacking”.

How to Get Started With Credit Card Rewards (And Earn $600)

For the newbie, I recommend the Chase Sapphire Preferred card as your starting point.

Previously, both my wife and I signed up for our own Chase Sapphire Preferred cards, and after we each met the $4,000 spending requirement in the first three months, we received 50,000 points each for a total welcome offer of 100,000 points!

This offer is now expired but has been replaced by an even better one, with the Chase Sapphire Preferred now offering 60,000 points after you spend $4,000 in the first 3 months. Be advised, though, there is a $95 annual fee on this card, but this is offset by double points back on travel, as well as numerous benefits such as trip cancellation insurance. Better yet, when you redeem through Chase Ultimate Rewards, those 60,000 points are worth $750 towards travel!

INTEREST EARNED – $140

We have a decent amount of cash sitting around in emergency funds and reserve funds for our rental properties, as well as money waiting to be invested in passive crowdfunding projects.

This month we earned $140. Most of our money is in an Ally Bank account earning 2.2%, but I still need to move it over to CIT Bank which consistently pays the highest interest rate I’ve been able to find (currently 2.4%).

CIT Bank Has the Best Interest Rate I Can Find Anywhere

If you’re looking for a good bank account to hold your emergency fund, or other cash savings, I highly recommend looking into CIT Bank.

By being online only they are able to keep expenses down and offer the best interest rate I can find without sacrificing service.

REALTOR COMMISSIONS – $0

As part of our real estate investing side hustle (see below), my wife got her real estate license mainly to save on transaction costs for our own purchases. However, it costs a decent amount of money to maintain her license ($2-3k per year), so she takes on clients here and there. These are almost exclusively friends, family, and referrals. She doesn’t do any marketing to find clients.

My wife stays home with the kids (a much more than full-time job itself), but we’ve been surprised that she’s been able to net around $15-20k per year the last few years only working a few hours here and there. When she has a client, most of the work tends to be evenings and weekends, so I can watch the kids while she shows houses. I would say she spends less than 10 hours a month on this side hustle.

The realtor income is highly erratic. She might have a closing one month and make $5,000, and then not make any money for 3 or 4 months.

Not much to report in April. My wife took on a buyer client that may or may not pan out, and helped a few people find rentals for which she is still waiting to be paid.

Related: Everything I’ve Ever Done to Make Money

REAL ESTATE CROWDFUNDING – $3,944

Real estate crowdfunding brings in the holy grail of truly passive income. As we get busier with young kids and family life, we are trying to transition some of our gains from active real estate investing into more passive investments. Our real estate crowdfunding income represents the monthly income our invested capital is making for us each month.

If you don’t know what real estate crowdfunding is, you are basically contributing money to a large commercial real estate deal, either as a lender (debt) or as a part-owner (equity). The sponsor of the deal does all the work to find the property, negotiate it, fix it up, rent it out, and eventually sell it. You the passive investor just contribute capital to make the deal happen. You also get absolutely no say in how the property is run, so by far the most important aspect of my due diligence is looking at the sponsor and their past track record.

There are lots of platforms to get into real estate crowdfunding (RealtyShares – no longer accepting new investors, CrowdStreet, EquityMultiple, etc.) You can also find deal sponsors the old-fashioned way through networking with other people. That is how I’ve found most of the sponsors I’ve invested with.

I’m currently invested in a few different deals:

- A fund that invests in land deals and single family rental houses

- An apartment complex that happens to be 5 minutes from my house

- A fund diversified across multifamily, commercial, and industrial properties

- A fund that invests in Class C apartments in the Midwest

- A fund that invests in Class B/C apartments in the Southeast

- A fund that invests in retail shopping centers

- A life settlement fund (not real estate, but still passive private equity)

Over time, I generally expect my passive real estate investments to return 12-15% per year (IRR). They are all long term investments though, with the money locked up for 5-10 years. Some give me a monthly payment of the cash flow the property generates, and some don’t pay out until everything is sold off in 5 or 10 years.

April Update: Several of the deals we invest in pay out their preferred return quarterly, so January, April, July, and October will have abnormally high cash flow. This month we received $3,944 from all of the crowdfunding deals we are invested in.

How to Get Started in Real Estate Crowdfunding

If you’re brand new to real estate and don’t have a lot of money to invest, I would recommend starting small. Two platforms I like are Groundfloor and Fundrise.

- Groundfloor allows you to participate in loans backed by real estate (as little as $10 per loan last I checked). While I no longer contribute to my Groundfloor account, I got an annualized return of 12.5% over the past couple of years across all the various loans I helped to fund. If you’re interested in learning more about Groundfloor, click here. (get a $10 bonus when you open an account through that link!)

- Fundrise lets you invest in a diversified portfolio of real estate with as little as $500. Because it is a private fund and your money is tied up for 3+ years (unlike a public REIT) the returns tend to be higher, and the low minimum makes it a good introduction to crowdfunding. You can check out Fundrise here and see if it could help you meet your investment goals. (affiliate link)

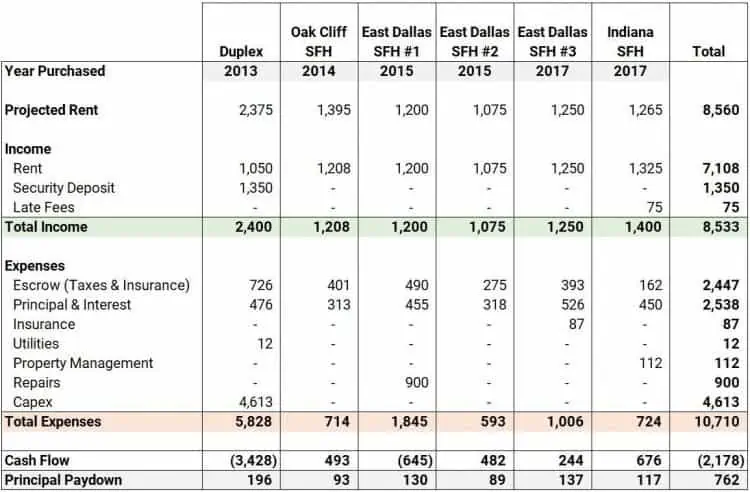

RENTAL PROPERTIES – ($2,178)

Rental properties are where our side hustle journey began. We are now 5 years in, and currently have a small portfolio of 7 units. We aim to make about $300 cash flow per month per unit, which has gotten harder to do the last couple years as real estate prices have risen. You can read the story of how we got started in real estate investing here.

All but one of our rentals we self-manage (one rental is in a different state), so we market the property, pick the tenants, and answer the phone when there are problems. Most months nothing happens and there isn’t really anything to do but deposit the rent, but sometimes we get an emergency call that water is pouring out from under the house and we have to figure out how to deal with it. We’ve built up a good list of contractors we trust, which has helped tremendously in keeping costs down and tenants happy.

RELATED: How to Use the 1% Rule to Find Great Rental Properties

One thing I don’t include in the cash flow is the principal paydown on the mortgage. While this isn’t money coming in to pay the bills, it does slowly increase our net worth as the tenants continue to pay down our mortgages. Here’s the breakdown by property.

MONTHLY PROFIT AND LOSS BY PROPERTY

Overall, if everything is running perfectly – we collect all the projected rent checks, and our only expense is the mortgage payment, we would cash flow about $4,000 per month. That is the absolute ceiling, and of course you have to factor in other expenses such as repairs, property management, and vacancy.

So what the heck happened in April – how did you lose money?!

Yes you read that right, we LOST $2,178 on our rental properties this month.

This is the reality of rental property investing. If anyone tells you that you just buy a single family rental, collect the rent, pay the mortgage, and the rest is a steady flow of cash into your bank account every month, they are lying to you. Over time, our properties have averaged out to give us a good return. But we’ve had good months and bad months – even good years and bad years.

I’m still hopeful 2019 will turn out to be a good year, but based on some planned capital expenses and some bad news we just got, we may be in for a down year.

Here are the highlights for April:

- We have a new tenant in place in the duplex. Our previous tenant bought a house and moved out on the 9th. We posted the unit for lease and got over 100 inquiries in 7 days! We took several applications, did our due diligence and screening, and signed a lease to begin on 4/29. If you want to know more about how we find and screen tenants, read more about our simple rental application and tenant screening process.

- We spent several thousand dollars renovating the duplex. After the tenants moved out, we had to do some fairly extensive sprucing up of the place. It hadn’t been painted since we originally rehabbed it 6 years ago, the fence was falling down on one side of the house, and it needed a bunch of small repairs here and there (broken blinds replaced, trees trimmed, gutters cleaned, sink faucets fixed, etc.) All told we will probably spend close to $5,000 to get it in shape for the new tenants. None of it was unexpected, but this is why you need cash reserves when you have rental properties!

- We are planning to spend another $4,000 on the duplex. Over the years, we’ve had a lot of drainage problems that we’ve tried to fix various ways. All have failed, and this spring has been particularly wet. So we are planning to have a french drain installed along the whole side of the property along with some other work. Hopefully this will fix the issue for good. We’ve spent too much money on band-aid fixes to prevent water from getting into the house.

- A tree almost fell on one of our East Dallas rental houses. See above about our particularly wet (and windy) spring. The tenant texted me that a tree right next to the house had split in half during a rainstorm and was leaning on the roof. We got our tree guy out there ASAP. It is surprisingly expensive to have a tree removed, especially one so close to the house where they have to take extra precaution. That tree ended up costing us $900 to remove, and we will have to spend another $150 (not reflected this month) to have it hauled away.

- Our Indiana tenant is being evicted. Just to add insult to injury, we were notified that our Indiana tenant did not pay rent for April and an eviction has been filed. Not only will I not be collecting rent, but I will have to pay for the eviction process, and then pay again to have another tenant placed.

All in all, April was NOT A GOOD MONTH! And it looks like in May we will be lucky to break even, assuming nothing else goes wrong. Some days I love owning rental properties. Other days I just want to sell them all and be done with it. Such are the trials and tribulations of a real estate investor…

Blogging – $71

I’ve earned a few affiliate commissions from products I’ve recommended (thanks to those of you who signed up using my links – I’d love to know what you think of the products!)

This month, I got a $71 payout for various affiliate commissions. It’s not much, but it’s fun to make a little income from my hobby.

For now, I am really enjoying the process of writing out my thoughts on various personal finance subjects, and trying to figure out what kinds of content my audience gets the most value out of.

If you want to see our past income reports, check them out below:

- March 2019 Extra Income Report – $15,258

- February 2019 Extra Income Report – $5,787

- January 2019 Extra Income Report – $2,812

- 2018 Year in Review – Over $100,000 in Side Hustle Income

- November 2018 Extra Income Report – $6,378

- October 2018 Extra Income Report – $9,807

What do you do to make extra income on the side? Let me know in the comments!

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

Great to hear about you experiencing in crowdlending and real-estate crowdfunding! Check out my blog if you like. I report my income from European p2p lending platforms and publish my passive income.