If you are a federal employee, you are probably wondering how you can calculate your FERS pension benefit upon retirement.

Well I am NOT a federal employee, but a reader asked the me about the FERS retirement calculator and I am here to tell you that the answer is…complicated (come on – it’s the government, of course it’s complicated).

But never fear! I have waded through dozens of documents and antiquated and over-complicated FERS retirement calculators to bring you a simplified approach to approximating your pension payout.

But first, a little level setting.

WHAT IS THE FERS RETIREMENT PENSION?

FERS stands for Federal Employees Retirement System. It covers most civilian Federal government employees, and provides a pension annuity after you retire from your job. This pension is referred to as the FERS Basic Benefit.

It is one part of the federal retirement plan, which also includes Social Security and the Thrift Savings Plan (kind of like a 401(k) for government employees).

While the latter 2 components contribute to your overall retirement, the main goal of this article is to help you understand and calculate the FERS Basic Benefit (your pension).

One of the main benefits of working for the government is that they still offer a pension AND contribute to a defined-contribution plan like the Thrift Savings Plan. If I could start my career all over again, I would seriously consider looking for a federal government job. While the pay may not quite match up with the private sector, the benefits are unparalleled.

FERS BASIC BENEFIT CALCULATION

The FERS basic annuity formula is actually pretty simple, and is based on your salary and years of service.

FERS Basic Annuity = High-3 Salary x Years of Service x 1%

And if you retire at age 62 or older with 20+ years of service, you get a slight bonus (1.1% multiplier vs. 1%):

FERS Basic Annuity = High-3 Salary x Years of Service x 1.1%

How to Calculate Your High-3 Salary

The High-3 Salary is the government’s term for the average of your highest 3 years of base pay. It is usually your last 3 years of employment, but could be any consecutive 3 year time period when you had the highest pay.

Examples

I work best with concrete examples, so let’s say John is planning to retire at the age of 60 after 20 years of service. His last 3 years of employment he made $98,000, $100,000, and $102,000 for an average of $100,000. Since John retired before age 62, we will use the first formula. Here is how we would calculate his FERS basic annuity:

$100,000 High-3 Salary x 20 Years of Service x 1% = $20,000

So John would be eligible for a $20,000 annual annuity at retirement.

Complicating Factors

The basic formula seems pretty easy, but there are a lot of exceptions or modification depending on retirement age, years of service, and when you leave your job. There are also special provisions for certain jobs such as Congress or air traffic controllers, but we won’t even get into those! If you want the full excruciating detail, you can see the official documentation at the Office of Personnel Management’s website.

So let’s talk about the modifications to the basic benefit calculator. First up is eligibility – are you even able to take a pension?

ELIGIBILITY FOR FERS (FEDERAL PENSION)

A lot of people mistakenly assume that you have to work as a federal government employee for 20 or 30 years before you are eligible for retirement benefits, but this is not true.

When you are eligible, and the amount of benefit you are eligible for is a little bit of a tricky calculation, but here are the major components.

Minimum Retirement Age (MRA)

The minimum retirement age (MRA) is the age at which you can retire with benefits. Without going into too much detail, your MRA is between 55 and 57. 55 if you were born before 1948, 57 if you were born after 1969, and a sliding scale in between.

But wait, there’s more! You didn’t think it was quite that easy did you?

Depending on your years of service, you may be eligible for immediate retirement or deferred retirement. And years of service also determines whether you receive the full benefit, a reduced benefit, or even no benefit.

If you have less than 5 years of service, too bad so sad, you don’t get any benefit. That’s the easy case.

Let’s look at the other scenarios one at a time.

Immediate Retirement

If you meet one of the following conditions, you can apply for an immediate retirement benefit (that starts within 30 days from the date you stop working).

- Age 62 and at least 5 years of service

- Age 60 and at least 20 years of service

- MRA (age 55-57 from above) and at least 30 years of service

- MRA and at least 10 years of service

FERS Reduced Benefit Calculation:

If you retire under the last provision at your minimum retirement age, and have more than 10 but less than 30 years of service, then your retirement benefit is reduced by 5% for each year you are under the age of 62.

In a mathematical formula, your pension benefit would be calculated as:

Reduced FERS Basic Benefit = FERS Basic Benefit – FERS Basic Benefit * (62 – Current Age) * 5%

So, for example, if you were 57 and met the MRA requirement, but only had 15 years of service, your benefit would be reduced by (62 – 57) * 5% = 25%.

Deferred Retirement

If you leave federal government employment before retirement age, but have at least 5 years of service, you are eligible for deferred retirement. Your payout would not begin until you reached your eligible retirement age (either MRA or age 60+).

The same rules apply here as for the immediate retirement option, you just get to pick when that starts at some point in the future. So if you only had 5 years of service but chose to start taking retirement benefits at your MRA of 57, you would received a reduced benefit as described above. If you had 20 years of service and started taking retirement at age 60, you would get the full benefit.

OTHER FERS RETIREMENT CALCULATION CONSIDERATIONS

Cost of Living Adjustment

In addition to your initial pension payment, every year it will be adjusted for cost of living. The cost of living adjustment (COLA) is based on the Consumer Price Index, and should generally fall in the 1-3% range. The purpose is to adjust your pension to keep up with the rising costs of housing, groceries, transportation, etc. so that you can continue to live comfortably in retirement.

Social Security Benefit

In most cases, if you participate in the FERS system during your employment you are also eligible to collect social security. So in addition to your pension you will also receive a social security annuity benefit starting as early as age 62. To calculate your social security benefit, I recommend using the calculator on the Social Security Administration website. It is also a good chance to check and make sure that the earnings they are reporting for you there are correct.

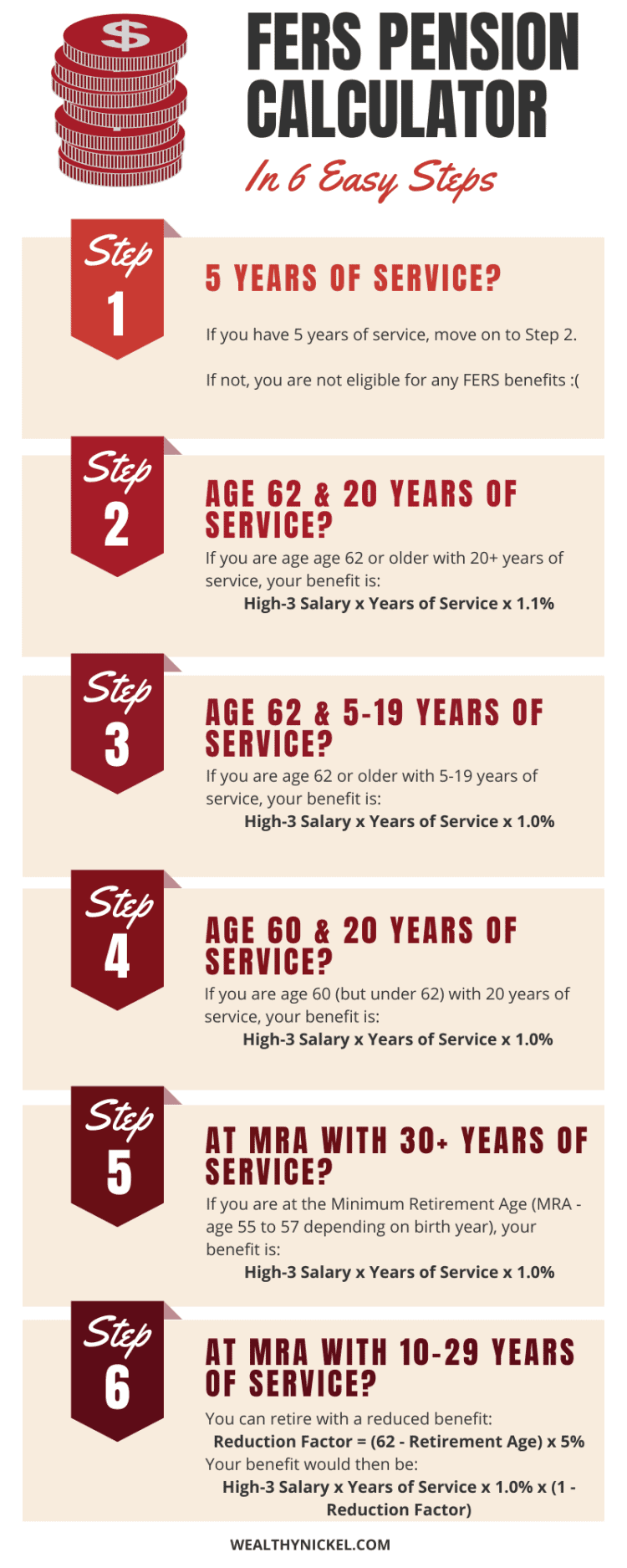

FERS RETIREMENT CALCULATOR IN 6 SIMPLE STEPS

Ok, if that was all a little bit of information overload, here are the simple steps to calculate your FERS retirement pension.

Here is the information you will need for the FERS Retirement Calculator:

- Your High-3 Salary (average of highest 3 consecutive years of base compensation)

- Years of Service

- Age when you will retire (immediate retirement) or age when you will start taking retirement benefits (deferred retirement)

And that’s it! Here are the steps to make sure you are eligible and calculate your benefit:

1. Do you have at least 5 years of service?

Great! Move on to the next step. If not, you are not eligible for any benefits 🙁

2. Are you retiring at age 62 or older with 20+ years of service?

If yes, you get the easiest calculation. Your benefit is:

High-3 Salary x Years of Service x 1.1%

If no, then continue to the next step.

3. Are you retiring at age 62 or older with 5 – 19 years of service?

If yes, your benefit would be:

High-3 Salary x Years of Service x 1.0%

If no, then continue to the next step.

4. Are you retiring at age 60 or older with 20+ years of service?

If yes, your benefit would be the same as above:

High-3 Salary x Years of Service x 1.0%

If no, then continue to the next step.

5. Are you retiring at the Minimum Retirement Age or older with 30+ years of service?

Remember, the minimum retirement age is between 55 and 57 depending when you were born.

If yes, your benefit would be:

High-3 Salary x Years of Service x 1.0%

If no, then continue to the next step.

6. Are you retiring at the Minimum Retirement Age or older with 10 – 29 years of service?

If yes, then you would be eligible for a reduced benefit. The reduction calculation is:

Reduction Factor = (62 – Retirement Age) x 5%

And your benefit would then be calculated as:

(High-3 Salary x Years of Service x 1.0%) x (1 – Reduction Factor)

If no, then you would not qualify for an immediate retirement. You could take a deferred retirement by waiting until a later age to begin taking retirement benefits. Pick an age when you would like to start taking retirement benefits and go through the questions again.

FERS RETIREMENT CALCULATOR EXAMPLES

Let’s run through a few examples of using the FERS Retirement Calculator steps above to calculate your retirement benefits.

Example 1 – Bob wants to retire ASAP and head to the beach

Let’s say Bob has been a federal employee his entire career. He’s ready to call it quits and sip mai-tais on the beach. He hired in at age 25 and he wants to retire at his minimum retirement age. He was born in 1960, so according to the FERS eligibility requirements, his MRA is 56. He made an average of $75,000 over the last 3 years of employment. So his variables are:

- High-3 Salary average: $75,000

- Years of Service: 56 – 25 = 31

- Retirement Age: 56

Stepping through the questions, he would answer Yes to #1 (at least 5 years of service), then make it down to #5. Retiring at the MRA with at least 30 years of service means his pension benefit calculation would be:

High-3 Salary x Years of Service x 1.0% = $75,000 x 31 x 1.0% = $23,250 per year or $1,937.50 per month

Example 2 – Sally is a late bloomer

Sally worked in private industry for most of her career, but came to work for the federal government at age 50. She wants to retire at age 65 so she can apply for Medicare and also start collecting social security benefits at the same time. She made an average of $100,000 over the last 3 years of her federal career. Her variables are:

- High-3 Salary average: $100,000

- Years of Service: 65 – 50 = 15

- Retirement Age: 65

Going through the FERS Retirement Calculator steps above, she would answer Yes to #1, No to #2, and Yes to #3. So her retirement benefit would be:

High-3 Salary x Years of Service x 1.0% = $100,000 x 15 x 1.0% = $15,000 per year or $1,250 per month

Example 3 – Michelle wants to retire early after a short government career

Michelle was a high-flying executive in her early career and decided to use her management skills in a less-demanding job with the government after her kids were out of school. She started working for the federal government at age 54 and knows she needs to work at least 5 years to earn a pension so that’s what she does, planning to retire slightly above her MRA at age 59. She made an average of $150,000 her last 3 years (management has its perks). Her variables are:

- High-3 Salary average: $150,000

- Years of Service: 59 – 54 = 5

- Retirement Age: 59

Looking at the FERS Retirement Calculator steps, she would answer Yes to #1 (barely), and No to everything until #6. So she is eligible for a reduced pension.

First we would calculate the reduction factor:

Reduction Factor = (62 – Retirement Age) x 5% = (62 – 59) x 5% = 15%

Next we would calculate her pension payout:

(High-3 Salary x Years of Service x 1.0%) x (1 – Reduction Factor) = $150,000 x 5 x 1.0% x (1 – 0.15) = $6,375 per year or $531.25 per month

Not too bad for only working 5 years!

FERS RETIREMENT CALCULATOR FAQ

Here are a few answers to common questions about the FERS federal pension system. If you have any further questions, feel free to leave them in the comments!

What is the minimum retirement age for FERS?

The short answer is, it depends. Your Minimum Retirement Age (MRA) is between 55 and 57 depending on when you were born. With 30 years of service, you can retire at your MRA with full benefits. With 10 years of service you can retire at your MRA with reduced benefits.

There are an additional 2 scenarios that do not depend on your MRA: you can retire at age 62 with 5 years of service, or at age 60 with 20 years of service.

For more detail, see the Minimum Retirement Age section above. The age you retire also factors in to the FERS retirement calculator.

How is FERS High-3 calculated?

Your High-3 average salary is the highest annual salary that results from averaging your base pay over any three consecutive years of service. For most federal employees, this would be the 3 year period immediately preceding retirement, but it could conceivably be any consecutive 3 years of service (the key is they must be consecutive).

Is FERS retirement taxed?

Unfortunately, your FERS retirement pension is taxable. Your pension benefit will be taxed at ordinary income rates, so be sure to account for that when figuring your annual income and expenses from all sources such as Social Security, 401(k) and IRA distributions, etc.

Note that you will get your FERS contributions back tax-free (that were withheld in each paycheck), but this will generally only account for 2-5% of your total pension payment.

How do I calculate my FERS retirement?

At a basic level, your FERS retirement benefit is calculated as 1% of your high-3 average pay multiplied by your years of service. If you are retiring at age 62 or older with 20+ years of service, you would use a factor of 1.1% instead of 1%.

Can I collect FERS and Social Security at the same time?

Yes, when you retire you will receive both a federal pension benefit AND a Social Security benefit. Prior to 1984, federal employees participated in the Civil Service Retirement System (CSRS) that replaced their Social Security benefit. But after FERS was introduced in 1984, federal employees were part of the Social Security system and paid into it via payroll taxes like everyone else.

THE SIMPLE MATH OF FERS RETIREMENT

I hope this has been helpful in showing that the basic math behind the FERS retirement calculation is not that hard. But there are a lot of factors to take into account.

If you are seriously looking into retiring from the federal government, this is a good starting point to estimate your pension. But I must stress that I am not an expert on the FERS retirement system! Like with any retirement plan, it’s great to start with a ballpark estimate, then begin working through the details with your HR department or another professional.

If you read through this whole article and are NOT a federal employee, then you are either a math nerd or are seeing the light to one of the major benefits of government employment – the pension system.

For anyone looking to secure their retirement, I think working for the government for some portion of your career could be a good fit if you have the right skills. I know I’m looking into it now!

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

I like how you talk about being at the minimum retirement age before you can begin to calculate how much the funds are going to cost in order for you to be able to have a nest egg to look forward to in the future–especially if you’ve worked at least five years or more. While there are certain factors that would push for early forced retirement or other things, it’s important to have a nest egg started on so that you can enjoy the golden years after having worked your entire life. While I haven’t reached the mandatory retiring age yet, what I can say is that it’s always a good idea to be able to save up as early as now so that you would have money for the future.

how does VERA/VSIP play into this? I am 52, have 22 yrs total gov time, avg base+ locality is 50K/yr and am going to be offered 40K VERA/VSIP soon.

From my understanding, if you are offered voluntary or involuntary early retirement, you are eligible for the FERS pension as long as you are age 50 with 20 years of service, or any age with 25 years of service. Here is some more info: https://www.opm.gov/retirement-services/fers-information/types-of-retirement/#url=Early-Retirement

Does Sunday Pay and Double Sunday pay…because Your workday on Saturday night spills over into Sunday morning…do both count in computing your federal retirement?

I believe all base pay counts, but I don’t know for certain.

Question: I am an DoD civilian who was deployed to Iraq in late 2009 thru late 2010. I was a GS-13 then. My understanding is that Locality differential (35%) and Hazardous Pay (35%) is included when figuring out my highest three consecutive years of salary. Is this true? Also, I know overtime Pay is not included in the calculation but I was not paid OT in Iraq but worked 12 hours days, 7 days a week at what would be my deployed my hourly rate which includes locality and hazardous pay (OT time like 1% was not added for the four hours extra I worked every day). Would a 12 hour day apply to my calculation or the 8 hr. day?

Hi Anthony. From my understanding base pay would include anything from which retirement deductions are withheld, so shift/locality differentials would apply. But I would recommend you contacting your HR department or someone at OPM.gov to get a definite answer. There are a lot of complicating factors that can affect your pension number.

How long do you receive the annuity? The rest of your life, or does it run out?

Yes, the annuity would last for the rest of your life, with survivor benefits for the spouse.

Great information – – thank SO MUCH!!