The absolute hardest part of my budget to control is grocery spending. There, I said it. And what I’ve found from talking to others is that I’m not alone.

So how much should I spend on groceries?

It’s easy for me to track how much I’m spending every month on food, but somehow it always feels like it’s too much. Trying to figure out what is a realistic, achievable grocery budget is really difficult.

If you do enough Googling, you’ll inevitably come across articles like “How I Feed My Family of 7 on $150 per month” or “How I Eat Organic Everything for Less Than a Trip to McDonald’s”. It can be hard to parse out the good advice from an extremely specific case study (like how the family of 7 also has a working farm so they don’t count most of their food costs at all).

I’m not here to judge how much you spend on groceries or even tell you that you need to cut back. Hopefully this article will help you decide for yourself what the right level of spending is on food for your family.

HOW MUCH SHOULD I SPEND ON GROCERIES?

This is obviously a loaded question with all kinds of variables. Such as:

- How many people are in your family?

- How old are the members of your household?

- How much do you eat out?

- Do you have any dietary restrictions?

- What part of the country do you live in?

All of these variables can result in vastly different food budgets. If you have a husband, wife, and 3 teenagers living in Hawaii with a gluten and dairy intolerance you’re obviously going to be spending more money on groceries than a couple with no kids living in the Midwest with no dietary restrictions.

Stop the Guilt and Money Shaming

I first want to eliminate some of the guilt associated with spending on food. If you are reading this article, you probably have at least some shame associated with your grocery spending habits. While saving money on groceries is not difficult, and there are usually some easy places to cut – spending money on quality food for your family is OK!

I have a gluten intolerance (among several other things) and I follow a paleo-ish diet, which is a lot of meat and vegetables. It tends to be more expensive than the USDA recommendations where you can get a lot of your calories from cheap grains such as wheat, oats, corn, etc. But I am not about to sacrifice my health just to save a few bucks at the grocery store.

Everyone’s situation is different, and comparing your spending to others is usually not helpful. You need to figure out what works for you, and build your budget around that.

- If you find yourself mindlessly throwing pre-packaged meals into your grocery cart because you don’t meal plan, perhaps you should consider how much money you could save by buying raw ingredients and preparing at home.

- If you are shopping exclusively at Whole Foods and buy organic everything, perhaps you should consider prioritizing what needs to be bought organic (such as looking at the dirty dozen list of worst produce for pesticide residues), and what doesn’t.

So seriously, how much should I spend on groceries?

If you want the simple, no B.S. answer, here it is:

Spend as much as you are comfortable with to buy high quality, nutritious food without being wasteful or outspending your income to do so.

Ambiguous? Yes. But it’s true.

If you want more help figuring out a specific number to shoot for, keep reading! >>>

So with that out of the way, let’s get to a basic outline of how to figure out how much you should spend on groceries:

- Historical Average Household Spending on Food Since 1900

- Current Average Household Spending on Food

- The 4 levels of the USDA Recommended Food Budget

GOOD NEWS! YOU SPEND WAY LESS THAN YOUR GRANDPARENTS DID

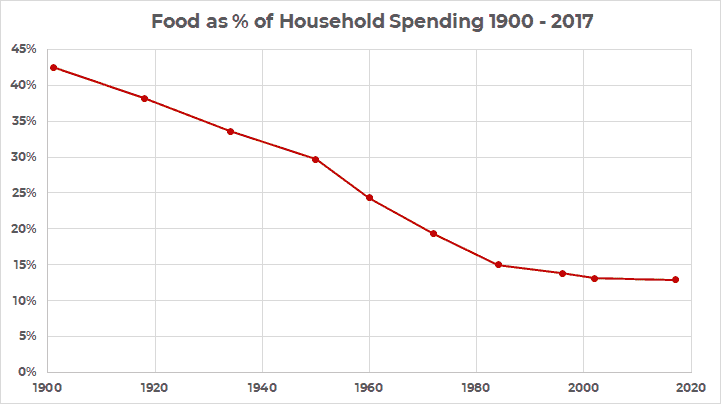

There’s an interesting report from the U.S. Bureau of Labor Statistics on the past 100 years of U.S. consumer spending.

As a percentage of total spending, food has gone from almost 43% of spending in 1901 to 13.1% in 2002 (the last year of data in the report). If you use the latest Consumer Expenditure Survey data, the number has fallen slightly to 12.9% in 2017.

There are many factors that contributed to the downward momentum in spending on food. In the first half of the 20th century, real wages (after inflation) were rising quickly giving people more discretionary income to spend elsewhere. Later on, efficiencies in production, supply chain, and the “factory farm” model continued to push prices lower even as real wages had somewhat stagnated.

Whether or not the factory farm model and big business applied to agriculture is a good thing overall for the economy and our health is a different question that I am definitely not going to address here. But suffice to say, it has contributed to falling grocery prices.

WHAT DOES THE AVERAGE AMERICAN SPEND ON FOOD?

That brings us to today. A good benchmark for how much you should be spending on groceries is what the average American is spending. And of course, if you want to be ambitious and get on the path to financial freedom, you always want to shoot for better than average!

According to the 2017 BLS Consumer Expenditure Survey, the average American spends 10.5% of their income on food. This includes groceries (6%) and dining out (4.5%).

Those numbers are a little surprising to me – as a culture we spend almost 5% of our incomes on going out to eat! If you’re looking for ways to save money on groceries, it seems like swapping a few restaurant meals per month for meals cooked at home is an easy win.

My Personal Food Budget

If I look at my own budget in comparison to the average American, the Wealthy Nickel family of 4 has spent right at 9% of our income on food in the last 12 months, 7% on groceries and 2% on eating out. I’m happy to be doing better than average, but still wish we could get that grocery budget down just a bit.

If we’re getting technical, there are a few household items (mainly diapers and bathroom products for the kids) in our grocery line item that could be stripped out. I’m all about tracking your spending and budgeting, but nitpicking to that level of detail is just not worth it to me.

How Income Level Affects Grocery Spending

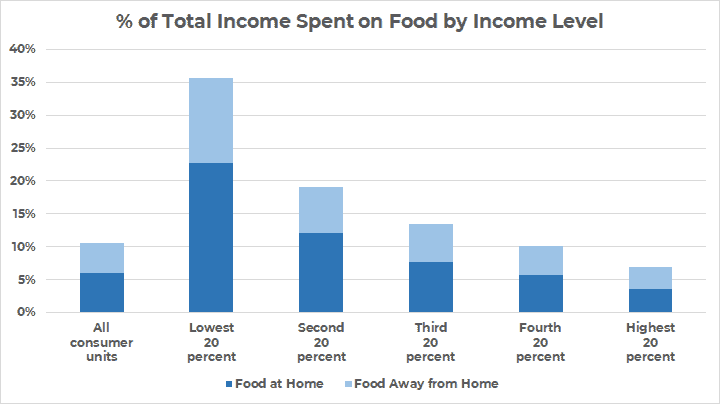

One thing I found interesting from the Consumer Expenditure Survey was the breakout by income level.

While the average overall spending on food was 10.5%, it varied drastically by income:

- The first quintile (lowest 20%) had an average income of $11,394 and spent 36% of their income on food

- The second quintile had an average income of $29,821 and spent 19% of their income on food

- The third quintile had an average income of $52,431 and spent 14% of their income on food

- The fourth quintile had an average income of $86,363 and spent 10% of their income on food

- The fifth quintile had an average income of $188,103 and spent 7% of their income on food

I found this result interesting, as there is obviously a lower bound on how much you can spend on food. Even if you make very little money, food is a high priority and so a larger chunk of your budget is allocated to it. Even if you subsist on beans, rice, and ramen, that is a significant portion of a very low income!

On the flip side, the highest income earners spent more than 3 times as much on food as the lowest earners, but comparatively this was only a fraction of their total income. At some point, you top out on your grocery spending even if you’re shopping at Whole Foods and eating out all the time.

RELATED: 17 Shocking Personal Finance Statistics Everyone Needs to Know

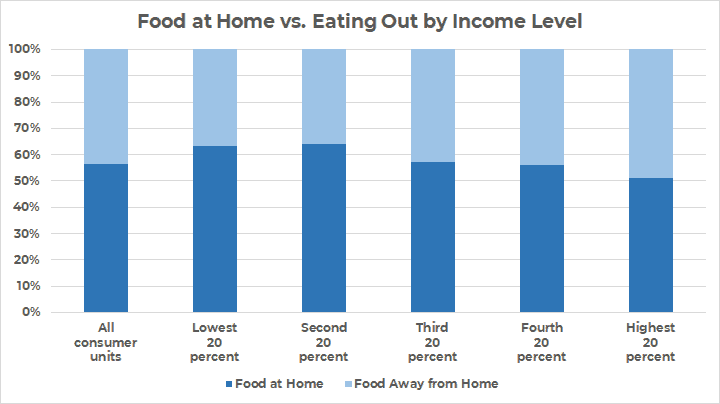

Grocery vs. Restaurant Spending

The next thing I found interesting was the amount of money spent on groceries versus eating out. At lower income levels, more of the average family’s money went to eating at home. But as you climb the income ladder, more and more of your food budget goes to restaurant meals.

This makes sense, but also shows that lifestyle creep is a real thing. The more you earn, the more you spend on food in general, and on convenience in particular.

RECOMMENDED SPENDING ON GROCERIES (STRAIGHT FROM THE GOVERNMENT)

At this point you might be asking yourself, why should I tie my grocery spending to my income? Food doesn’t magically become more expensive just because you make more money.

What really drives food spending is two things:

- the quality of the food (which people at higher income levels can afford and justify), and

- the number of people in your household raiding your pantry every day.

Well this is your lucky day! The U.S. Department of Agriculture (USDA) compiles exactly this data for you to help you figure out how much you should be spending on groceries. The USDA tracks the cost of their recommended food plans and releases a cost of food report monthly.

USDA Grocery Budget Guidelines

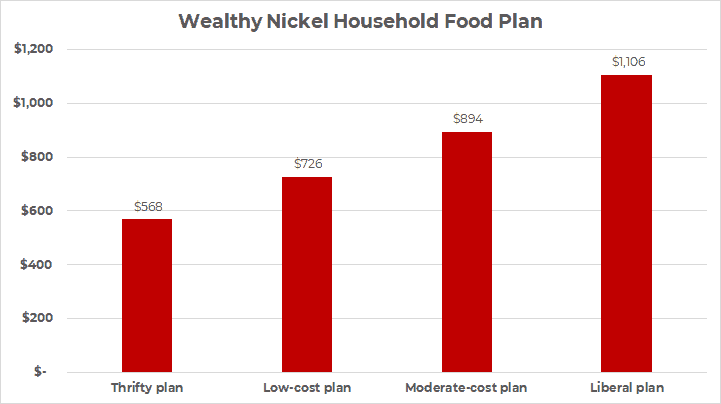

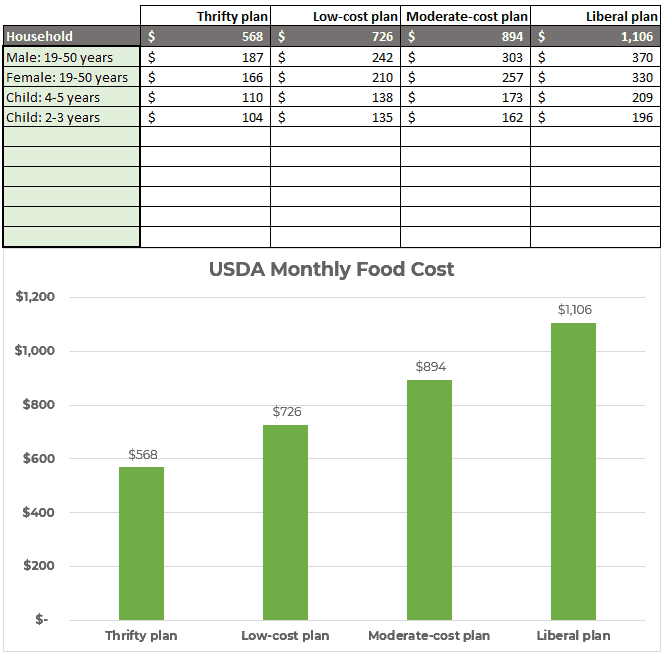

Based on the USDA dietary guidelines, they publish costs of 4 different food plans: thrifty, low-cost, moderate-cost, and liberal.

All 4 plans meet the guidelines for healthy eating, but while in the thrifty plan you may get more of your protein from beans and chicken, in the liberal plan perhaps you get that same protein from salmon and lamb chops.

And crucially, this data is segregated into a per-person cost that takes into account age and gender to determine total calorie needs. Here is the data straight from the latest USDA cost of food report:

- 1 person household – add 20%

- 2 person household – add 10%

- 3 person household – add 5%

- 5-6 person household – subtract 5%

- 7+ person household – subtract 10%

The Wealthy Nickel Family Food Plan

For the rest of this section, I’ll use my own family as an example. We have a household of four people – one 35 year old male, one 33 year old female, one 4 year old female, and one 2 year old male.

Based on the USDA recommendations, our actual grocery spending falls somewhere between the thrifty and low-cost plan. If you add in our restaurant spending, we’re in between low-cost and moderate-cost.

I prefer comparing our food spending to the USDA recommendations rather than the general “percent of income” method precisely because it takes into account household size and ages. Our kids are young, but even now they are making a pretty significant dent in our food budget. I can’t imagine when they become teenagers!

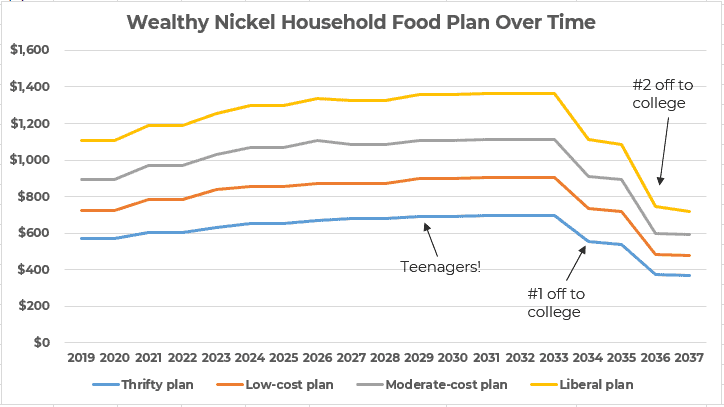

Just for fun, I plotted our monthly food costs over the next 19 years (by which time our kids should be grown and hopefully out of the house). As you can see, as they get older and eventually become teenagers, our food budget peaks and then comes down again as they leave the house and it’s just my wife and I and our glorious empty nest.

Incidentally, this also shows the power of buckling down on our food budget. Hypothetically, if we were able to stick to the low-cost plan rather than the moderate-cost plan, and invest the difference at an 8% return, we’d add almost $100,000 to our net worth over those 19 years.

And if we could get down to the thrifty plan (probably not as likely) we could add almost $200,000 to our net worth vs. the moderate-cost plan!

Get the FREE Monthly Food Budget Calculator (no email required!)

If you want to play around with the numbers yourself, I’ve created a quick calculator in Excel so you can do just that. Just enter each of your household members and it will display a graph of the USDA recommended budgets for your family!

Screenshot of Monthly Food Budget Calculator

SO HOW MUCH SHOULD YOU BUDGET FOR GROCERIES?

Whew, that was a lot of data. At the end of the day, you have to answer the question for yourself of how much should I spend on groceries.

My personal recommendation if you have an somewhat “normal” income, is that 10% of your income is a good figure to shoot for.

Then, compare that number to the USDA food budget guidelines for the thrifty and low-cost plans for your particular household size and ages. I think almost everyone should be able to get their spending into one of those ranges.

If you find yourself way outside the ballpark, don’t worry. There are plenty of ways to save money on food that don’t require a ton of effort:

- Try to shift a few restaurant or take-out meals each month to food prepared at home

- Shop at ALDI (seriously – this probably saves us $100+ a month)

- Use an app like Ibotta to get cash back at the grocery store without messing with coupons

- Strategically shop sales, especially on meat

- For even more tips, see my article on 7 easy ways to save money on groceries while still eating healthy

Ibotta – Get Paid to Buy Groceries (and a $10 sign-up bonus)

Ibotta is my favorite app for getting cash back on your everyday grocery store purchases.

The amazing thing about Ibotta is there are always offers out there even for grocery staples you buy all the time that aren’t name brands (for example 50 cents off any receipt, 25 cents off any brand of eggs, or 25 cents off bananas).

The average Ibotta user can make $20 per month ($240 per year) just for doing their normal grocery shopping, and Ibotta has paid out over $438 MILLION in cash back.

How much do you spend on food? What tips do you have to save money on your grocery bill?

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

Hi Andrew. I really found your blog to be helpful. The best part was that you are down to earth and have a realistic view on things. Sometimes it’s hard to take a blog advice seriously when they make it seem so simple ( the family with the working farm who don’t count that). Also the USDA Grocery Budget Guidelines was super helpful. Thanks so much !