“We’re going to need a personal net worth statement…”

That was what the loan officer said, as if it was the most obvious thing in the world. It was the first time we were trying to get a loan at a local bank for a property my wife and I were planning to fix up and sell.

I panicked a little bit – what was a personal net worth statement? How was I going to come up with that?! Until then, our bank records were a little bit of a mess.

Fortunately with a little bit of work (and a lot of combing through bank statements), we were able to put together our personal financial statement and get the loan we needed to buy the house.

At the end of the day, a personal net worth statement is not as scary as it sounds. I actually think everyone should have one. Since then it has helped us get a clearer picture of our finances and make the best decisions to increase our net worth and accelerate our path to financial freedom!

WHAT IS A PERSONAL NET WORTH STATEMENT?

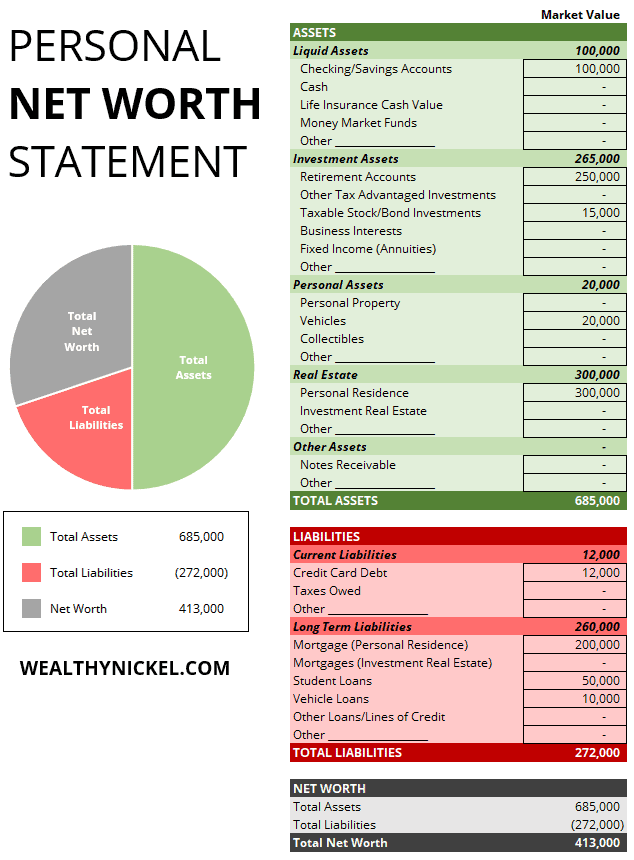

A personal net worth statement or personal financial statement is simply your personal balance sheet. If you were a business, what would you be worth? Add up the value of all your assets (what you own), and subtract the value of your liabilities (what you owe), and that is your net worth.

Here is the simple personal net worth formula:

Assets (What You Own) – Liabilities (What You Owe) = Personal Net Worth

A personal net worth statement helps you document and categorize your assets and liabilities so you can always have a running total of your net worth.

Often times you will need this if you are looking to take out a loan or line of credit from a bank, as they want to know that if things go south, you have enough assets to pay back the loan.

But tracking your net worth is also the best way to get an overall picture of your financial health.

RELATED: 6 Personal Finance Metrics You Can’t Afford Not to Track

DOWNLOAD THE PERSONAL NET WORTH STATEMENT WORKSHEET

Click the link above to get your own editable version of the Personal Net Worth Statement in Excel (XLS) and start tracking your net worth today!

WHY YOU NEED A PERSONAL NET WORTH STATEMENT

I mentioned before that I recommend that everyone should have a personal net worth statement. It is an important personal finance tool in your toolbox.

Here are several reasons you should have a net worth statement for yourself or your family:

- To get an accurate picture of your overall financial health – Ideally your net worth should be increasing over time. Periodically reviewing your net worth statement can help you see where your money is going. Your checking account balance doesn’t tell the whole story. You could have a growing bank account, but if you have a large amount of credit card debt or student loan debt that you aren’t paying down, your net worth could be going in the wrong direction.

- It helps you plan for the future – Knowing your net worth number is great, but having a personal net worth statement that shows exactly what kinds of assets and liabilities you have is important. For example, if you have a lot of your net worth tied up in assets that are not easily accessible (such as real estate or other long-term investments), you may decide you need to increase the cash in your emergency fund so you are prepared for short term needs.

- It may be required by a lender – As in our own personal story above, in some cases when you are getting a loan from a bank, they may ask to see a personal net worth or financial statement. Another scenario where this comes up is with college financial aid. If you applying for scholarships or other financial aid, they may want a personal net worth statement for qualification purposes.

- If you want to do any “alternative” investing – If you want to invest in real estate syndications, private equity, or other forms of alternative investments, there are often minimum net worth requirements. For example, when we started investing in real estate crowdfunding, we had to submit extensive documentation to show that we qualified (based on SEC regulations) from a net worth perspective.

TRACK YOUR NET WORTH THE EASY WAY

I would be remiss if I didn’t mention one of my favorite tools that I use to keep track of my net worth in real time – Personal Capital.

You can link you accounts once to Personal Capital, and have them automatically refresh. It saves me a ton of time every month over manually checking each account.

There are also many other free features, such as budget tracking, portfolio analysis, and retirement calculators.

One thing to note – they do offer paid investment management services if you have a certain amount of money in your investment accounts. However, I have always only used the free features and been very happy with the app.

I still dutifully transfer everything to my net worth tracking spreadsheet (because I’m a nerd like that), but Personal Capital has been a great addition to my personal finance tool set.

Personal Capital helps me keep track of my net worth without having to worry about logging into 37 different accounts (ok maybe a slight exaggeration, but not much) to add up all my balances.

If you’re looking for a single app to help you keep track of your income, expenses, net worth, and investment accounts, I highly recommend giving it a try. It even helps you optimize your portfolio’s asset allocation and shows you where you can save on fees.

HOW TO SET UP A PERSONAL NET WORTH STATEMENT

Writing a personal net worth statement is as simple as listing all of your personal assets and liabilities.

Of course, depending on how complicated your finances are “simple” doesn’t necessarily mean “easy”. After we started investing in real estate, our financial picture got a lot more complicated. We had multiple rental houses along with multiple mortgages, and multiple bank accounts set up.

Determining the value of your 401(k) is as easy as looking at your most recent statement and recording the dollar figure. But determining the value of the rental house you bought 3 years ago is a little bit trickier. If you don’t have a recent appraisal, you have to resort to using your judgment or that of a real estate professional to determine a reasonable value.

Below are the categories you should consider when setting up your personal net worth statement. I can’t say this is an exhaustive list, but the goal is help you think through everything you own and everything you owe to get an accurate picture of your net worth.

DOWNLOAD THE PERSONAL NET WORTH STATEMENT WORKSHEET

Click the link above to get your own editable version of the Personal Net Worth Statement in Excel (XLS) and start tracking your net worth today!

ASSETS

Liquid Assets

Liquid assets include cash or anything that could quickly be converted to cash without losing value. Often banks will want you to have sufficient liquid assets to cover expenses for a certain period of time. Knowing your liquid assets can also help you calculate your liquid net worth.

- Checking/Savings Accounts – The current balances of all of your checking and savings accounts.

- Cash – Any actual cash in your possession (should you stuff it under your mattress for a rainy day).

- Life Insurance Cash Value – If you have whole life insurance, their may be a cash value to the policy that could be quickly liquidated in an emergency.

- Money Market Funds – Money market funds are similar to savings and may be held with a bank or traditional stock brokerage, but could be quickly converted to cash.

Investment Assets

Most people have investments of some kind whether through retirement accounts or other stock/bond holdings. But you can invest in all kinds of things such as businesses, or your friends awesome app he developed that he promises will make a ton of money!

- Retirement Accounts – Any investments you have in personal or company-sponsored retirement accounts, such as 401(k)s, IRAs, 403(b)s, etc.

- Other Tax Advantaged Investments – Other investments such as a 529 College Savings Plan for your kids

- Taxable Stock/Bond Investments – Any taxable investment brokerage accounts you have in addition to retirement plans

- Business Interests – If you have equity in any businesses (your own or someone else’s) the value of that would go here

- Fixed Income (Annuities) – Annuities provide a fixed payment over your lifetime or a defined period of time. They usually have a value associated with them, even if they are not easily sold or traded.

Personal Assets

Personal assets include anything you own of value for everyday household use, or other non-investment assets.

- Personal Property – The overall value of any valuable personal property you own such as furnishings, jewelry, clothing, etc.

- Vehicles – The current value of your automobiles (and your yacht if you’re a billionaire). I like to use the Kelley Blue Book value to make things easy.

- Collectibles – If you have art, antiques, or a really cool comic book collection, estimate the value here.

Real Estate

If you own your home or other investment real estate, you’d estimate that value here. You may need to enlist the help of a professional real estate agent or appraiser to get an accurate value. I would never personally recommend Zillow’s valuation algorithm, but if you are just keeping track for your personal records I suppose you could use the Zestimate.

- Personal Residence – The current market value of your personal home if you own it.

- Investment Real Estate – The market value of any real estate owned for investment purposes (houses, multifamily, commercial, etc.)

Other Assets

Any other assets not accounted for elsewhere.

- Notes Receivable – Any loans you’ve made to others, such as real estate notes or just a personal loan to friends or family.

LIABILITIES

Current Liabilities

Current liabilities are generally those that are due within one year (hence “current”). So things like credit cards or short term loans.

- Credit Card Debt – Current balances owed on any credit cards (even if you pay them off every month).

- Taxes Owed – If you owe any federal, state, or local taxes, or are keeping track of your quarterly tax payments if you’re a small business owner record that here.

Long Term Liabilities

Long term liabilities are those that loans that you owe further out in the future, such as a 30-year mortgage or student loan debt.

- Mortgage (Personal Residence) – The principal balance on your mortgage if you have one on your primary residence.

- Mortgages (Investment Real Estate) – The principal balance on any mortgages you have on rental properties or other real estate investments.

- Student Loans – The current amount owed on any school debt you may have.

- Vehicle Loans – The principal owed on your auto loans (hopefully it’s lower than the value of the vehicle itself!) Also, if you are a billionaire and you took out a loan on that yacht you claimed as an asset, that would go here. But shame on you – don’t take out loans on luxury goods!

- Other Loans or Lines of Credit – If you have a personal loan, credit card consolidation loan, or other line of credit from a bank add that in here.

NET WORTH CALCULATION

Your net worth is calculated by taking your total assets minus your total liabilities. If you’ve documented everything above, it should be pretty simple math.

Net Worth = Assets – Liabilities

The first time you calculate your net worth, you might be in for a surprise. If you’ve only relied on your bank account balance to tell you how wealthy you feel, seeing your true net worth can come as a shock – either good or bad.

THE TRUE POWER OF YOUR PERSONAL NET WORTH STATEMENT

The benefit of having a personal net worth statement is not in what the actual number comes out to be.

The true power is in having an awareness of your total financial picture, and then tracking over time to make sure you’re going in the right direction.

For example, if you’re in your mid-20s, recently graduated with student loan debt and no real assets to speak of, you could have a negative net worth. As an over-simplification, if you have $50,000 in student loans and $5,000 in the bank, then your net worth is negative $45,000.

But that number by itself doesn’t tell you much. Sure you are starting in the hole, but you have your entire career ahead of you with opportunities to increase your earnings.

As you start to track your personal net worth statement over time, you should see it move in a positive direction. And by seeing the details behind your assets and liabilities, it will help you make better decisions with your finances.

Seeing that number go up can inspire you to find ways to save more money, or make extra money through a side hustle, to keep it headed in the right direction.

RELATED: 7 Ways to Make an Extra $500 a Month

FINAL THOUGHTS – OUR STORY OF TRACKING NET WORTH

When we first started investing in real estate, I was shocked at how quickly our net worth grew. We always aimed to buy a house at a maximum of 80% of market value, fix it up, and rent it out. Each house we purchased added an instant $20-$30,000 to our net worth because of the “sweat equity” we added. As they say, in real estate you make your money when you buy. That has definitely turned out to be true for us.

In the same way, by tracking your own personal net worth statement, you should be able to recognize the patterns and see where you should focus your efforts to continue to build wealth on the path to financial freedom.

CREATE YOUR NET WORTH STATEMENT WITH PERSONAL CAPITAL

If you made it all the way to the end of this article, you’re obviously interested in tracking and growing your net worth. If so, I highly recommend you check out Personal Capital. Their free app is the easiest way I know to see all your accounts in one place and get a snapshot of your financial health anytime you want.

Do you maintain a personal net worth statement? Let me know in the comments!

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

Very good article. I’m going through a few of these issues as well..