If you feel like you’re living paycheck to paycheck and constantly juggling which bill gets paid late, you’re not alone. Almost 78% percent of Americans say they live paycheck to paycheck.

If you want to break the cycle, sometimes you have to think outside the box. The paycheck budget is one way to do that.

There are a million different budgeting methods out there:

- 50/30/20 method

- cash envelope system

- Dave Ramsey’s budget percentages

- etc, etc.

But the one thing they have in common is they all assume a monthly budget. Hardly anyone gets paid once per month. More likely, you get a biweekly paycheck.

And if you’re struggling to make ends meet, you have to figure out how to fit all those monthly expenses into a biweekly pay cycle. It can be frustrating!

The ultimate goal is to break out of the paycheck to paycheck cycle, but in order to get there, you need a budget by paycheck that works for you and helps you achieve that goal.

Here are 7 simple steps to setting up a paycheck to paycheck budget to finally take control of your finances once and for all.

THE PAYCHECK BUDGETING SYSTEM

The main goal of the paycheck to paycheck budgeting system is to figure out when you get paid and when your bills are due. If your rent is due on the first of the month, but you don’t get paid until the fifth, where is that money coming from?

This simple budgeting method solves that problem and takes the stress out of not knowing if you’ll have enough money at the right time for that next upcoming bill.

So how do you get started? Here are 7 steps to follow to finally achieve budgeting success!

Step 1. Track your expenses

No matter what budgeting system you use, I think it is extremely important to track your expenses for a month or two before you establish a written budget.

If you don’t have any idea how much you’re spending, how do you know how much to budget? Before I started tracking my spending, I thought I knew what a reasonable amount of money was to budget for groceries. I had a “feeling” we were spending around $400 per month. Much to my surprise, our actual spending was almost double that!

Tools to Help You Track Expenses

There are numerous ways to track your expenses, so I won’t go into detail here. I use and recommend Personal Capital because it allows you to set up and auto-import all of your accounts so you can see them all in one place. Plus it tracks my retirement accounts and other investments, so it really is a one-stop-shop for my overall financial picture.

Some other good options include Mint.com, an Excel spreadsheet (what I used to use), or good old pencil and paper. If you’re the creative type, you might like printing out your bank statements and using a different color highlighter to mark and categorize each transaction. The important part is to find something that you’ll actually do – it doesn’t have to be fancy.

Once you’ve done this for a month or two, you should have a pretty good idea how much you spend on a recurring basis on things like food, household supplies, clothing, bills, etc. which makes the rest of the process of setting up your paycheck budget much easier.

Step 2. Figure out your income per paycheck

The goal here is to know when you get paid, and how much you earn per paycheck after taxes and other payroll deductions are taken out (your take-home pay).

If you get paid biweekly, the dates don’t line up month to month, so it’s important to keep track of this on an ongoing basis.

This is the key ingredient of what will make you successful with a paycheck to paycheck budget if you’ve failed with monthly budgeting before.

You can look at the previous month’s pay stubs, or if you have a variable schedule, estimate it based on the numbers of hours worked.

Let’s make this more real with an example. Take the prototypical American family – a husband and wife with 1.5 kids, a dog, and a white picket fence. (Ok, we’ll round the kids up to 2…half a kid is a little awkward). We’ll call them Bob and Suzy.

Bob and Suzy work and get paid biweekly on the same days for the upcoming month of August – the 8th and the 22nd.

Bob makes $1,100 per paycheck after taxes, and Suzy makes $1,150. So combined they make $2,250 per pay period.

Pro Budgeting Tip: Note that when converting from a monthly to a biweekly schedule, you will have 2 paychecks per month in most months, but since there are 26 pay periods per year, you’ll get a “bonus” check twice a year.

Try to establish your budget so you don’t need to rely on these extra paychecks, and put them toward your emergency fund or other investing!

Step 3. Budget for your recurring monthly bills

The next step is to sit down and go through ALL of your recurring monthly bills. If you have been tracking your expenses for a few months (Step 1), this should be pretty easy. You want to know what the bill is for, and also when it is due.

If you’re a visual person, you can write each bill amount and due date on a calendar, or just make a list. Recurring monthly bills are things like:

- Mortgage or rent

- Cell phone bill

- Utilities

- Cable

- Subscription services

- Child care

- Debt payments (credit cards, student loans, etc.)

Bob and Suzy’s paycheck budgeting example:

Bob and Suzy went through all their recent bank and credit card statements to come up with the following recurring bills:

- Cell phone – $100 (due August 10th)

- Car payment – $250 (due August 12th)

- Utilities – $200 (due August 12th) – estimated from previous bills

- Daycare – $500 (due August 18th)

- Internet – $50 (due August 23rd)

- Netflix – $15 (due August 24th)

- Student loan – $200 (due August 28th)

- Rent – $1200 (due September 1st*)

- Total – $2,515

* Since our example starts with a paycheck on August 8th, the budgeting period actually goes from August 8th – September 4th (4 weeks covering 2 biweekly pay periods)

Step 4. Budget by paycheck for monthly variable expenses

Variable expenses are pretty much all the other things you buy on a regular basis, but aren’t a consistent bill. You should budget and plan for these expenses out of each paycheck, and perhaps set aside a weekly or bi-weekly amount for each category.

Make sure you are checking in regularly on these expenses, as it can be easy to go over budget if you’re not careful. It takes self-discipline to say “no” to that trip to Target if you know you don’t have any money left in the budget that week.

Variable expenses are things like:

- Groceries

- Restaurants

- Gas

- Household and personal care goods

- Entertainment

- Other personal spending

Bob and Suzy’s paycheck budgeting example:

After tracking their expenses for a few months, Bob and Suzy think that with a little tightening of the belt, they can stick to the following budget per paycheck (every 2 weeks):

- Groceries – $250

- Restaurants and takeout – $50

- Gas – $75

- Household supplies – $100

- Entertainment and other personal spending – $200

- Total – $675 per paycheck

Step 5. Budget for irregular expenses

Irregular expenses have the power to make or break your paycheck budget. Especially if you are in a cycle of living paycheck to paycheck, any unexpected expense could potentially destroy your budget. You definitely do not want this to happen!

Irregular expenses are just that – they don’t happen on a regular schedule. But that doesn’t necessarily mean they are unexpected. For example, you can pretty much plan on the fact that your car will break down or need maintenance at some point this year, but you don’t know when.

So the point of this step is to make sure you’re setting a little money aside every paycheck so that when the inevitable does happen, you’re not caught off guard. These funds go into a sinking fund, which is an account set up to put money into regularly in anticipation of a future expense. So when you vacation rolls around, your sinking fund should have enough cash sitting in it to pay for the trip, so you are not stressed out about putting expenses on your credit card.

Make sure you sit down and really think about your irregular expenses. There will always be surprises (such as these emergency fund examples), but you should be able to plan for most things.

Here are some common irregular expenses to get you started:

- Car insurance

- Vacations and other travel

- Birthday and Christmas gifts

- Back to school shopping

- Car maintenance

- Home repairs

- Annual membership dues

If you feel like you might be missing something, check out this list of 80+ personal budget categories. It might remind you of a few expenses you forgot!

Bob and Suzy’s paycheck budgeting example:

Based on past history, Bob and Suzy expect to spend the following every year on irregular expenses:

- Annual vacation – $2,000

- Car maintenance – $1,000

- Gifts – $600

- Car insurance – $1,200 ($600 every 6 months)

- Kids summer camp – $400

- Total – $5,200 per year or $200 per paycheck

Step 6. Plan your cash flow

Here’s where you put your budget into action! Line up your income, regular monthly bills, variable expenses, and irregular expenses, and make sure you’ll have enough money in the bank to pay the bills.

This is especially important for large bills such as the rent check. You want to make sure you will be able to fund the rent payment with your paycheck and not have to pay a late fee because you got paid a day or two too late. By planning ahead using the paycheck budget you should be able to eliminate this nightmare scenario and know where your money is at all times.

I think explaining this concept works best using our favorite stock photo couple, Bob and Suzy.

Bob and Suzy’s paycheck budgeting example:

If you recall, they brought home a total of $2,250 per biweekly pay period, and their paychecks are received on August 8th and August 22nd.

So on August 8th they receive $2,250 in their bank account, and it is budgeted for the following (from our examples above):

- $1,050 – Recurring bills from 8/8 – 8/21

- $675 – Variable expenses from 8/8 -8/21

- $200 – Set aside for irregular expenses

- $1,925 – Total expenses

At this point, Bob and Suzy have a surplus of $325 in their bank account. Hooray! But let’s not spend the money yet, there are still some big monthly bills to pay from the second paycheck (namely the rent).

On August 22nd, Bob and Suzy receive $2,250 in their bank account and need to pay the following expenses:

- $1,465 – Recurring bills from 8/22 – 9/4

- $675 – Variable expenses from 8/22 – 9/4

- $200 – Set aside for irregular expenses

- $2,340 – Total expenses

As you can see, they went over their $2,250 paycheck by $90. So it’s a good thing we didn’t spend the surplus from Paycheck #1! We can use that to cover the additional expenses at the end of the month.

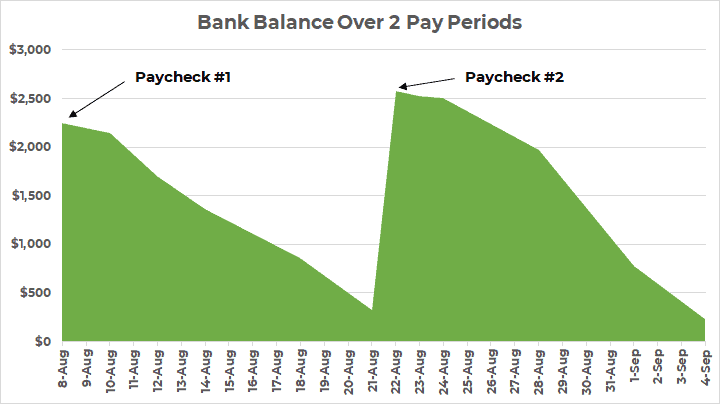

If you’re a more visual person, here’s an example of how their bank account will look assuming it started at $0.

- August 8th – Payday! +$2,250

- August 21st – $325 left after 2 weeks of expenses

- August 22nd – Payday! +$2,250

- September 4th – $235 left after 2 weeks of expenses

Note that this includes pulling out the money set aside for irregular expenses ($200 per paycheck) into a separate account for safekeeping. I don’t know about you, but if I have money just sitting in my checking account it takes willpower not to spend it.

I recommend moving this money into a high yield online savings account such as CIT Bank that will earn you 20X or more interest than it would sitting in your checking account. While it’s still easily accessible if you have a car repair come up or need to book a flight for your vacation, it’s separate from your normal day-to-day expenses for safe-keeping.

Step 7. What to do with a surplus

If you notice in our example above, Bob and Suzy had a surplus of $235 at the end of the month even after setting aside $400 into their sinking fund for irregular expenses. So what should you do with that extra money?

What to do with surplus money:

- Start or increase your emergency fund to prepare for unplanned expenses

- Add it to your retirement savings through a 401k or IRA

- Accelerate your debt paydown by putting extra money toward the balance

- Invest in education or startup costs for a side hustle to make extra money

PAYCHECK TO PAYCHECK BUDGET REVIEW

That was a lot of information, but the basic idea of a paycheck to paycheck budget is pretty simple.

If you’re struggling to pay the bills and want to alleviate the stress of not knowing if you’ll have enough money at the end of every month, ditch the monthly budget and start budgeting your paycheck. Get granular and attach a date to every bill and expense in your budget so you know ahead of time if you’ll have enough cash in the bank.

Here’s a quick overview of the paycheck budgeting plan:

- Track your expenses. Know what you spend so you can set a realistic budget.

- Write down your income. Figure out your take-home income per paycheck.

- Figure out your recurring monthly bills. Budget for your recurring monthly bills (and include the specific due date).

- Figure out your other regular day-to-day expenses. Set a weekly or biweekly budget for things like groceries, personal, and household spending.

- Plan out your irregular expenses for the whole year. For things like car maintenance and vacations, divide up the annual cost and set aside a little bit from every paycheck into a separate account.

- Plan out your cashflow. Line up when you get paid with when your bills are due, and make sure you will always have enough money in the bank to pay your bills on time!

- Make a plan for your surplus. Whatever is left over in your budget is not just free money – put it to good use securing your future whether in an emergency fund, retirement account, or something else (see these investing tips for beginners for some ideas).

What budgeting method works for you? What challenges have you run into?

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

Great breakdown of the simple steps needed to make your salary past the entire month. It can be so overwhelming budgeting like this but you explained it pretty well. Tip 7 is pretty important, overall because it helps break the cycle of living paycheck to paycheck. Will definitely share!