Real estate investors love to brag about their cash flow or cash-on-cash returns, but for my money I think return on equity is the most important real estate metric you should measure for your rental properties.

The big question that real estate return on equity (ROE) allows you to answer is “when is it time to sell?”

Especially with the large increases in appreciation the last few years, as a sophisticated investor you need to know how much money you’re making and how much you could be making with the equity trapped in your rental property.

I personally sold two of my properties last year, even though they were good, cash-flowing rentals, because the return on equity got so low that it just wasn’t worth holding onto them anymore. But more on that later…

4 WAYS TO MEASURE REAL ESTATE ROI

There are lots of different ways to measure your return on investment in real estate. Each one has its pros and cons and tells you different things about your investment.

Here are some of the main ones you’ll hear thrown around:

1. Cash Flow

You’ll hear lots of investors brag about how much cash flow they get from their properties.

Unfortunately cash flow by itself doesn’t tell you very much.

If I told you I had a house that cash flowed $1,000 a month I bet you’d be pretty impressed, right?

But what if I told you that I had $500,000 tied up in that property to generate $1,000 a month?

Much less impressive. You could get that kind of return by putting your money into a savings account.

2. Cash-on-Cash Return (CoC)

So if cash flow doesn’t mean much, let’s take it a step further – your cash-on-cash return.

Cash-on-cash is a pretty straightforward metric. It’s the amount of cashflow you make after expenses divided by how much you have invested in a property.

As a simplistic example if you bought a house (that followed the 1% rule for investment properties) for $100,000, put $25,000 down and made $1,200 per year after all expenses (mortgage, repairs, vacancy, etc.), your annualized cash-on-cash return could be calculated as:

CoC Return = Annual Cash Flow / Cash Invested

CoC Return = $1,200 / $25,000 (downpayment) = 4.8%

While cash-on-cash is an easy number to calculate, it starts to lose meaning further out in the future or if you are using creative financing or finding creative ways to invest in real estate with no money down.

If you were able to buy a similar house as above at a discount because it needed a lot of work, you should be able to add “sweat equity”. Maybe you bought it for $50,000 and put $25,000 of work into it. Afterward it was worth $100,000 and you were able to get financing for 75% and pull out all of your money.

You now have zero dollars invested and are making the same $1,200 per year in cash flow. You are technically making an infinite return on investment just because you don’t have any cash in the deal!

3. Internal Rate of Return (IRR)

IRR may be the single best way to compare different real estate projects to each other to see which one produces the best return.

But IRR is also complex to calculate and sometimes difficult to understand.

According to Investopedia, the definition of IRR is this:

The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Yikes. You’d have to have a degree in finance and a textbook to unpack what that means.

So I’ll just say that IRR is a powerful calculation that has its place, but it’s not my first choice for a back-of-the-envelope metric to track. Now let’s all just slowly back away…

4. Return on Equity (ROE)

Return on equity in real estate blends the simplicity of cash-on-cash returns with some of the benefits of longer term planning of IRR.

Return on equity takes into account your overall return on investment given the amount of equity you have in a property.

In addition to actual cash flow, it takes into account the fact that your loan balance is decreasing over time (if you have a mortgage), and also any appreciation of the property.

It’s also the best metric I know to compare you other types of investments, such as stocks. By definition, your return on investment in the stock market is the same thing as return on equity.

Say you have $1,000 invested in AAPL. Your equity (how much your AAPL stock is worth) is $1,000. If it goes up 10%, then your return on equity is 10%.

We’ll get into why this is important in just a bit, but let’s dive a little deeper into return on equity.

REAL ESTATE RETURN ON EQUITY

As you can see, trying to calculate your true returns in real estate and compare them to other investment options can be tricky.

But return on equity is the best measure I’ve found to help me make better decisions in my investments. Any sophisticated real estate investor should be using return on equity to help them maximize their returns.

With that said, how do you calculate return on equity?

Return on Equity (ROE) = Total Annualized Return / Equity

So we need to know 2 things:

- Equity

- Total Annualized Return

Let’s start with understanding what counts as equity…

What is Equity in Real Estate?

So what is equity in real estate? In simple terms, it’s the amount of cash you would put in your pocket if you sold your property today.

If you’ve owned a rental property for a few years, think about how much it’s worth now compared to when you bought it.

Our Super-Simple Fictional Rental Property

Example Equity Calculation:

Going back to our original example of the $100,000 rental property, let’s say we bought it 5 years ago with $25,000 cash and took out an $75,000 mortgage.

If we bought it for market value, then on the day we bought it, we had $25,000 in equity, represented by the down payment we made. (I am ignoring closing costs for simplicity).

But over the last 5 years, two things have happened:

- The mortgage balance has decreased.

- The house has (hopefully) appreciated and is worth more than we paid.

So the equity we have now is equal to our original equity ($25,000) plus any principal pay down on the mortgage and appreciation.

Over 5 years, the mortgage balance would be reduced by approximately $6,200. And if the house appreciated at 3% per year (the long term average over time), it would be worth $116,000 today.

So the total equity would be:

Equity = $25,000 (original down payment) + $6,200 (principal reduction) + $16,000 (appreciation) = $47,200

So now instead of owning a $100,000 house with $25,000 in equity, we have a $116,000 house with $47,200 in equity.

Even if you made zero cash flow over those 5 years, you’ve still increased your net worth by $22,200 – not bad!

How to Calculate Total Annualized Return

Now that we’ve figured out how to determine the equity, how do you calculate the total annualized return?

Whereas cash-on-cash return only took into account the actual annual cash flow into your bank account, the total return for return on equity includes a total of 3 factors:

- Cash flow

- Mortgage principal pay down

- Appreciation

So to restate the formula:

Total Annualized Return = Cash Flow + Principal Pay Down + Appreciation

Example Total Return Calculation:

A decent assumption for example purposes is that our income and expenses increased at the same rate as appreciation (3%).

Our actual cash flow increases at a faster rate because one expense, the mortgage payment, stays fixed over time. So after 5 years, our original $1,200 of annual cash flow is now close to $2,000 per year.

Also in year 5, we would pay down about $1,300 in mortgage principal, and with 3% appreciation the home would gain around $3,400 in value.

So our total annual return is:

Total Annual Return = $2,000 (cash flow) + $1,300 (principal pay down) + $3,400 (appreciation) = $6,700

How to Calculate Return on Equity in Real Estate

So now putting it all together is simple:

Return on Equity (ROE) = Total Annual Return / Equity

From our example above:

Return on Equity = $6,700 (total annual return) / $47,200 (equity) = 14%

Even though our example property only met the 1% rule (a pretty average rental), you can see that 5 years after purchase you are getting an overall 14% return which is pretty good in my book!

How Return on Equity Changes Over Time

Interestingly, under normal circumstances, your return on equity will always be highest when you first buy a property and then start to decline.

Why is that?

The main reason is leverage, the unsung hero of real estate investing.

When we first bought our property, we put 25% down, giving a leverage ratio of 4:1.

So if the house appreciates 3%, our total equity gain is actually 3% x 4 = 12%! (This works in reverse too if house prices go down.)

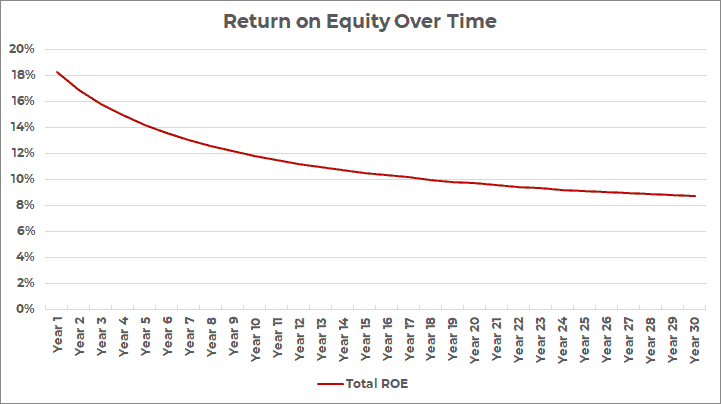

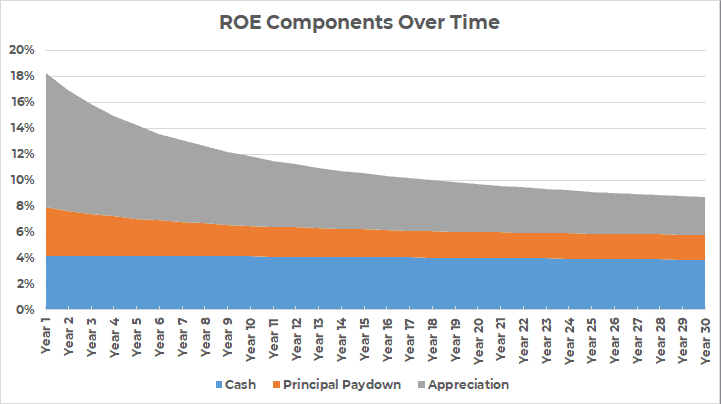

As equity increases and you pay down your mortgage, your leverage ratio goes down, and therefore your returns on equity decline. In the graph below, for our example investment property, you can see that over the 30-year mortgage pay down, total ROE starts at 18% and settles a little over 10% once the mortgage is paid off.

To get a little clearer insight into what is happening, let’s break the return on equity down into its individual components.

- The cash return on equity stays pretty stable, which makes sense because we assumed that rents will basically keep up with appreciation rates.

- The principal pay down declines slightly over time. Even though the actual dollar amount increases each year, the equity gain outpaces it so it becomes a smaller and smaller percentage of the return.

- The appreciation return on equity component is the big driver. As the home increases in value and you pay down the mortgage, your leverage ratio decreases over time. Eventually once the mortgage is paid off and you are no longer leveraged, the appreciation component of ROE will exactly match the appreciation rate of the property (in our example, 3%).

The Danger of Relying on Appreciation

While appreciation can be a large driver of your returns over time, it is dangerous to rely on it exclusively. All investments projections are only as good as the assumptions you make.

If you buy a house in the hottest part of town with zero (or negative) cash flow and count on appreciation alone to give you astronomical returns, you are not investing but gambling.

As many investors say, appreciation is the icing on the cake. I have a personal rule that I WILL NOT buy a rental property unless it cash flows, no matter how great a neighborhood it’s in or how much it’s appreciated in the past.

Leverage is a double-edged sword. It can exponentially increase your returns AND your losses. If the market turns and you have no cash flow to keep paying the mortgage month after month, you may be forced to sell and take a loss or face foreclosure.

Sure, buying for cash flow creates stable, boring returns. But if you’re investing in real estate, you should be doing so for the long term. It is not a get-rich-quick scheme.

HOW TO USE ROE TO MAKE BETTER INVESTING DECISIONS

Ok, so now that we’ve learned how to calculate return on equity for real estate, how do we actually use it to make decisions and become a better investor?

Great question!

By measuring your return on equity, it can help you decide when to get into an investment property or when to get out and invest in something else.

For example, I know that the stock market has returned 8-10% on average over the long term. I also know that I can invest completely passively in private equity real estate deals, and I estimate I should be able to make 12-15% over the long term.

I re-evaluate my rental properties at least once a year (or when a tenant moves out) to see how much equity I have in it and if it’s still producing returns that outpace what I could get in a more passive investment.

CASE STUDY: Why I Sold A Rental Property Last Year

Let’s look at one of my rental properties that I sold last year, and how I used ROE to decide it was time to sell.

My wife and I purchased a condo in 2012 for $110,000 as our personal residence. We put down 20% and took out a mortgage for $88,000. A few years later we had our first child and decided to move out and find a slightly larger place with a yard.

Instead of selling at that point, we decided to turn it into a rental. The market had already appreciated somewhat and our condo was worth somewhere around $150,000.

We rented it at $1,600 per month and after HOA dues, mortgage, taxes, insurance, and repairs we were cash flowing about $7,000 per year.

When our tenant moved out last year, we realized our condo had appreciated very substantially, and it was worth closer to $225,000. At that point, our mortgage balance was around $80,000 so our total equity was $145,000 ($225,000 – $80,000).

It was time to sit down with a calculator and figure out whether we should sell or continue renting. This is when keeping excellent rental property bookkeeping records pays dividends…

Let’s look at the components of ROE:

- Cash – We figured we could make about $5,000 per year in cash flow ( our property taxes kept increasing year over year and rents were not going up to match it).

- Principal paydown – At the time we were paying down about $2,000 per year of principal.

- Appreciation – This is the wildcard. We felt like the market was slowing down and we would not see the crazy 10%+ per year appreciation we had been in the past. We thought 3-5% was more in line with what we could expect going forward.

So to calculate our projected ROE, we did the following:

Total annual return $ = $5,000 (cash flow) + $2,000 (principal pay down) + $6,750 (3% appreciation on $225,000 value) = $13,750

Return on Equity (ROE) = $13,750 / $145,000 = 9.5%

So with our assumptions, our projected return on equity for our condo was less than 10%. Not terrible, but we felt that if we sold and invested that money into private equity commercial real estate deals, we could get a better return of 12-15% without the hassle of dealing with tenants or maintaining the property.

And that’s what we did! We ended up selling the property and have slowly allocated the profits to crowdfunded real estate deals.

Some investors recommend “buy and hold forever”. But I think it makes you a smarter, better investor to regularly re-evaluate your properties and decide whether it still makes sense to hold them.

Selling vs. Refinancing

I should point out that one other option we considered was refinancing the mortgage to pull out some of our equity, re-leverage, and therefore increase our return on equity. If we could have gotten a new loan at 75% LTV, we could have pulled out over half our equity, but we would have basically wiped out our cash flow by increasing the mortgage payment.

As I mentioned above, I do not ever want to over-leverage a property so much that I get zero or negative cash flow, no matter how good the overall return numbers look on paper.

Many people lost everything in 2008 because the market turned and their houses were over-leveraged. I would rather slowly build wealth over 30 years than take the risk of losing it all and having to start over.

How to Get Started in Real Estate Crowdfunding

In the case study above, I mentioned selling my rental and investing in real estate crowdfunding.

If you’re brand new to real estate and don’t have a lot of money to invest, I would recommend starting small. Two platforms I like are Groundfloor and Fundrise.

While that is certainly no guarantee of future results, I do think that real estate is one of the safer ways to invest in debt because you have a hard asset behind the loan (unlike with peer to peer lending where the only thing you have is a credit score and a promise to pay).

Our own personal Fundrise portfolio is highly diversified across equity and debt deals, and in different geographic locations. I like that Fundrise gives you details on all of the individual properties you are invested in through the fund.

FREQUENTLY ASKED QUESTIONS

Here are some frequently asked questions related to return on equity in real estate.

What is Return on Equity in real estate?

Return on equity in real estate is a measure of the percentage return on a real estate property divided by the total equity. Return on equity takes into account the total gain (cash flow, appreciation, etc.) as a percentage of the total equity (net amount of cash received if property were sold).

Return on equity provides a better measure of returns compared to the stock market or other investments, rather than using ROI or cash-on-cash returns.

What is equity in real estate?

Equity in real estate is calculated by subtracting the mortgage or other debt from the total value of the property. In other words, it is the amount of money you would receive in the even the property was sold today.

Equity can increase over time due to appreciation of the property or pay down of the mortgage debt.

What is a good return on equity?

What makes a good return on equity in real estate depends on your risk tolerance and goals. The average return on equity in the stock market over the last 100 years has been 9-10% (before inflation), so ideally as a real estate investor you would want to try to beat that return especially if you are taking on leverage in the form of a mortgage.

Is ROI the same as ROE?

No, ROI is not the same as ROE. ROI is return on investment, which is the total annual return divided by the original amount invested. ROE is return on equity, which is the total annual return divided by the current equity owned in the property.

In the case of ROI, the denominator will always be the same (original amount invested), whereas with ROE, the denominator is subject to change as debt is decreased or the property increases in value.

How do you calculate equity in real estate?

Equity in real estate is calculated by subtracting the total debt on a property from the total value of a property. For example, a property worth $250,000 with a $200,000 mortgage would have a total equity position of $50,000.

RETURN ON EQUITY: A POWERFUL TOOL FOR YOUR REAL ESTATE TOOLBOX

If I lost you somewhere along the way in all the math (sorry about that – I tend to geek out sometimes), I hope you at least got the main points:

- Return on equity is a powerful metric that every sophisticated real estate investor should use to help them make better decisions.

- ROE = Total Annual Return (Cash Flow + Principal Paydown + Appreciation) / Total Equity

- Equity is a measure of how much of your net worth you have tied up in a property, and the amount of cash you would have in the bank if you sold it today.

- By using return on equity, you can compare a rental property to other types of investments such as stocks, bonds, or other real estate opportunities.

Even as a small time landlord, I want to make sure I’m making the best investing decisions possible. And measuring return on equity allows me to build wealth faster (and more safely) than many other measures of real estate returns!

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

Loved learning more about the math behind your reasoning. Thanks for putting this together. Once my husband and I have more time and more cashflow again (aka kids out of daycare), we are debating between a rental or putting more in the stock market. Posts like this are really useful as we weigh some pros and cons.

Glad it was helpful and not too math-heavy! I understand with young kids in daycare – part of the reason we are slowing down on our real estate investing for now.

I’m a commercial LL and have small shopping centers some of which are paid off and have no debt. In this scenario is my ROE = NOI/Equity (i.e market value) + any appreciation?

I struggle with adding “appreciation” into the equity part of the equation b/c m “equity” is equal to the market value.

Should equity also include large capital improvements like new roofs, parking lots, HVAC units?

Should equity also include major Tenant Improvements for a new tenant? Last year I spent $80K on one TI project for a 7 year lease.

Finally, (when an asset has no debt on it) its seem like the ROE formula is the same as calculating your Cap Rate (NOI/ market value).

I look forward to your reply or hearing from you.

Saul Arizpe

Different people probably have different opinions on this, but to me equity = market value. So if you added market value with large capital improvements or tenant improvements, that would affect the calculation. If not, I would not include it. Of course this is different than the book value or tax value for accounting purposes.

Hey Andrew, thanks for sharing your insights. Your calculation and example make the concept of ROE crystal clear. I have a question on a hypothetical scenario, where the real estate has a high ROE (let’s say 20%) only because of a high paydown, while both the appreciation rate and cash flow are low. Let’s assume it has a moderate appreciation rate (3%) and it has a negative cash flow. Would you still think this property is good to invest in this situation? Does the negative cash flow bother you?

I personally would not invest in a property with negative cash flow – too much risk. You could always put more money into the property (and less mortgage) to increase cash flow, but that would obviously decrease ROE.