Are you looking for ways to diversify your investment portfolio into real estate? Maybe even boost your returns?

In case you haven’t heard, crowdfunded real estate is here to stay. And there are so many options out there it can be hard to narrow down your choices.

There are two platforms I really like and have personally invested in, so I wanted to bring you the inside scoop on Groundfloor vs. Fundrise.

Both companies allow you to invest in real estate without much money, and boast an impressive track record.

Let’s see how they stack up and which one is right for you!

Groundfloor vs. Fundrise – A Quick Overview

Before getting into more detail, here is a quick overview of Groundfloor and Fundrise.

Depending on your goals (income versus equity growth) and time horizon, one platform may be a better fit for you. I’ve personally invested in both Groundfloor and Fundrise, and have found they each have different benefits.

- Groundfloor allows you to invest in debt backed by real estate, and usually has a short time horizon of 1 year or less. With Groundfloor, you choose individual projects to invest in and how much money you want to contribute to each. For money I might need within the next year or two, I’ll invest it with Groundfloor.

- Fundrise lets you invest in a diversified portfolio of real estate – both debt and equity. Fundrise makes it clear up front that you should not invest money you think you might need in the next 3-5 years, and there are penalties for withdrawing funds within the first 5 years. The tradeoff is that you get to participate in both income (dividends) and appreciation (equity growth). For money I want to grow for the long term, I’ll invest it with Fundrise.

Click here to get a $20 bonus when you start investing with Groundfloor (September ONLY)!

What Is Crowdfunded Real Estate?

Real estate crowdfunding is not a new concept. It’s been around in some form for decades, particularly for high-net worth individuals with the right connections.

However, legislation passed in 2012 called the JOBS Act, and subsequent SEC guidelines now allow non-accredited investors (a fancy term for not super-rich investors) to participate in real estate crowdfunding.

At its core, crowdfunding allows multiple investors to invest in the same loan or entity, and participate in the profits depending on how much money they contribute.

For example, if a house flipper needs to borrow $200,000 to purchase and renovate a house, without crowdfunding, the flipper would need to find a single person willing to lend the full $200,000.

However, crowdfunding allows the flipper to still borrow the $200,000, but from dozens or even hundreds of different investors pooling small amounts of money together. So as an investor, instead of needing $200,000 to invest in the deal, you can invest with only $10, $100, or whatever amount you are comfortable with.

This ends up being a benefit to both the flipper, who now has access to a much larger pool of investors, and the investors, who can invest much smaller amounts of money and diversify among multiple deals.

Groundfloor Overview

I’ve been investing in Groundfloor since 2017, and they have been continually growing and innovating since that time. They are one of the largest platforms available to non-accredited investors, and have the lowest investment minimum I’ve seen anywhere at only $10.

How Does Groundfloor Work?

Groundfloor offers crowdfunded investments in loans made on individual properties. Most loans available are for single family or small multi-family houses that are being bought, fixed up, and either sold or refinanced.

They offer what is known as “hard money” financing – short term financing for purchase and repair costs. Normal banks will generally not lend on properties that need extensive repairs, so hard money lenders offer these loans at higher interest rates and shorter terms, with the expectation that once the property is rehabbed the hard money loan will be paid off.

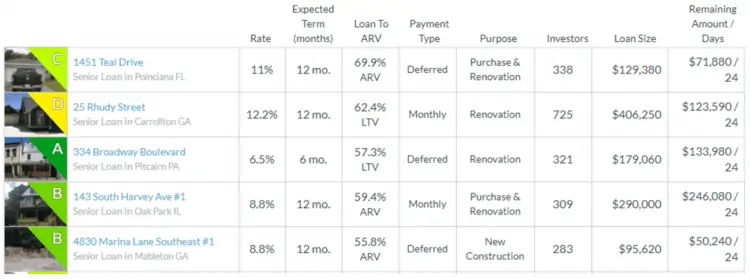

As an investor, you get to pick which loans you invest in, and Groundfloor has strict criteria for how it grades the loans based on risk.

They rank loans from A (least risky) to G (most risky) based on several criteria:

- Loan to ARV ratio (how much is being borrowed as a percentage of the after-repaired value)

- Quality of valuation report (e.g., an independent appraisal is a better valuation than borrower provided comps)

- Skin in the game (how much of their own money does the borrower have in the deal)

- Location (they assign more risk to some geographic locations than others)

- Borrower experience (how many projects have they completed and what is their track record)

- Borrower commitment (is this something the borrower does to earn a living or are they just flipping on the side)

Once Groundfloor performs their due diligence, they assign a letter grade and interest rate for the riskiness of the loan. They then publish the details and allow investors to invest in the loan (in $10 increments).

As you can see in the example above, there are loans that vary widely in risk, interest rate, length of loan, etc. Depending on your comfort level and risk tolerance, you may choose less-risky loans that pay lower interest rates on average, or take on additional risk of a large rehab or higher loan-to-value ratio for additional potential return.

What is the Minimum Investment?

The minimum investment to start a Groundfloor account is just $10.

Each loan you invest in also has a minimum investment of $10. So if you want to diversify your investment across 5 different loans, you would need $50 ($10 per loan).

How Much Can I Earn with Groundfloor?

While real estate obviously has risk and no returns are guaranteed, Groundfloor has published that their average investment return in the past has been 10%. Most loans have an expected return of 7 – 14% depending on the risk profile.

In my own experience, I’ve been able to make an average return of a little over 12%, which I think is great compared to the stock market and other investment opportunities. I have seen overall returns come down a few percentage points the last couple of years as real estate lending has become more and more competitive, so I think 10% is a good number to shoot for going forward.

What Fees Does Groundfloor Charge?

Groundfloor does not charge the investor any fees to invest money on the platform.

They do, however, charge the borrower an origination fee – usually 2-4% of the loan amount, plus closing costs. This is how Groundfloor makes its money. Individual investors (that’s you) collect the interest on the loans, and Groundfloor earns the origination fee paid by the borrower.

What Happens if the Borrower Defaults?

If you look at my investor statement above, you will notice that 3 of my loans were in default. That means that the borrower did not pay the loan back on time or violated some other term. In my case, all 3 actually ended up working out in my favor (11.4% return vs. 10.8% expected return) and I received a greater than expected return, though that will not always be the case.

Once the loan goes into default, Groundfloor charges the borrower a higher interest rate until the loan is paid off, which is passed on to investors. In my case, the borrowers were all able to either sell the property or refinance the loan after going into default, and paid back the loan with additional penalties and interest.

However, in some cases, the borrower may not be able to pay back the loan, and Groundfloor will initiate foreclosure and take over the property. They will then sell it and distribute proceeds to the investors. With a low enough loan-to-value ratio, even at fire sale prices, they should be able to recover most of the capital. But there is always the risk that you could lose the principal in the loan.

Diversification into multiple loans can help offset this risk. But as with all investments, don’t invest money you can’t afford to lose! Even investing in stock index funds can result in a loss (remember the 2008 recession?)

How Can I Get Started Investing in Groundfloor?

It’s pretty easy to get started investing in Groundfloor:

- Click here to set up an account (and get a $20 bonus if you invest in September!)

- Link your bank account and transfer funds to Groundfloor

- Review the loans that are currently funding and select 1 or more to invest in

And that’s it! You’re now the proud owner of a small piece of a real estate loan!

Fundrise Overview

Fundrise is another great alternative to Groundfloor to invest in real estate with a small amount of money. I personally started investing in Fundrise earlier this year, and have been impressed with the amount of detailed reporting provided on my portfolio.

How Does Fundrise Work?

Fundrise is a bit different than Groundfloor. Whereas with Groundfloor you are investing in individual loans, with Fundrise you invest in various funds (called eREITs) that consist of multiple commercial real estate loans or equity ownership of real estate projects.

Fundrise has different eREITs that target the following goals:

- Investing for income (steady dividends)

- Investing for growth (lower dividends but higher potential appreciation)

- Balanced investing (balance between dividends and growth potential)

You might be wondering, what the heck is an eREIT? And that’s a good question. I had to do some research to really understand the difference between a REIT and an eREIT.

A REIT (real estate investment trust) is a publicly traded commercial real estate fund that you can buy or sell in your normal stock brokerage account. They are highly regulated, and have certain liquidity requirements because they can be bought one day and sold the next. The fund invests in a diverse portfolio of real estate projects, but because of liquidity requirements it generally is more correlated to the stock market. So if stocks go up or down, REITs tend to move up or down too, regardless of the underlying assets being real estate, not equities.

An eREIT is basically a private REIT. It is not as liquid as a REIT, and because of that has a longer investment time horizon in mind which allows it to make longer-term decisions on what projects to invest in. You still get the diversification into many different projects, but because there is less liquidity, returns are generally higher, and correlation to the stock market is lower.

Once you invest your money, Fundrise does all the work of allocating it across different projects and funds to achieve your investment objectives. Fundrise invests in all kinds of commercial real estate deals with varying levels of risk and return such as:

- real estate loans

- multi-family apartments

- office and warehouse buildings

- ground-up development

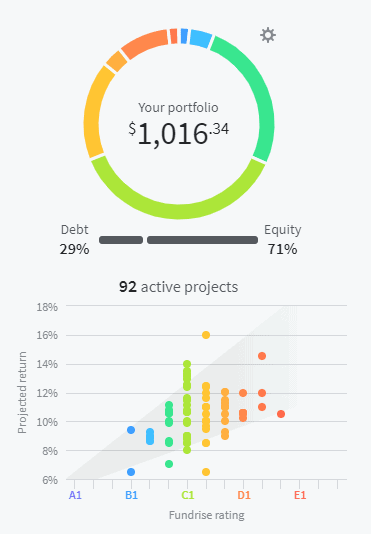

I am invested in a Balanced Portfolio, which is a blend of different projects to try to achieve both dividend yield and future equity growth. Like Groundfloor, Fundrise grades their investments based on risk and projected return. Generally, the higher the risk, the higher the expected return.

Based on my personal portfolio, here is my allocation between equity, debt, and project risk:

What is the Minimum Investment?

With Fundrise, you can invest in the Starter Portfolio with just $500. This is a balanced portfolio of growth and dividends.

Later on, you can choose to invest in one of their Core plans with an additional $500 investment. The Core plans offer different investment objectives and additional diversification.

How Do I Get Paid and When Can I Cash Out My Shares?

Fundrise earns money in two ways – through dividends (cash flow) and appreciation (share value increases). You can choose to get your dividends paid out automatically to your bank account whenever they are issued (usually quarterly).

You can also redeem your shares at any time with a few caveats. Real estate is a long term investment, and Fundrise emphasizes this fact by stating you should have an investment timeline of at least 5 years.

If you redeem your shares prior to 5 years, you will received a discount amount back based on how long you have been invested. If you are invested for less than 3 years, you get 97% back. Less than 4 years, you get 98% back. And less than 5 years, you get 99% back. After 5 years you will get your full investment back.

NOTE: One of the things I like best about Fundrise is they stand behind their product. If you are not happy with the platform within the first 90 days, you can redeem your shares for the full 100%! So really, the penalty for early withdrawal does not start until after the first 3 months.

What Fees Does Fundrise Charge?

Fundrise charges a 1% management fee (0.85% asset management fee and 0.15% investment advisory fee). You can think of this like a management fee on a traditional mutual fund or REIT.

In my experience, these fees are fairly competitive with other private real estate offerings. Almost all of them charge an asset management fee, and acquisition fees for each individual property. These fees are to cover overhead costs of staff that manages the assets, completes the financial reporting, and all the other things that go into finding and purchasing commercial real estate deals.

What Kind of Returns Can I Expect with Fundrise?

As with Groundfloor, the usual real estate disclaimers apply. Don’t invest money you can’t afford to lose, and past returns are not indicative of future results!

However, Groundfloor has published it’s track record going back to 2014:

- 2014 – 12.25%

- 2015 – 12.42%

- 2016 – 8.76%

- 2017 – 11.44%

- 2018 – 9.11%

The last several years have been great for real estate (and stocks), and the future may not be the same. But I like that Fundrise allows me to diversify my portfolio into real estate in a way that is uncorrelated with the stock market.

You won’t be able to invest $1000 and double it in a few years like you potentially could by getting actively involved in real estate investing and buying property yourself. But Fundrise allows you to passively invest with no work on your part, which is a great benefit.

How Can I Get Started Investing in Fundrise?

Fundrise makes it easy to get started:

- Click here to set up an account.

- Choose the amount you want to invest (minimum $500), and the type of portfolio based on your investment goals.

- Fundrise will allocate your investment and do the rest of the heavy lifting!

Groundfloor vs. Fundrise – Who Wins?

Groundfloor and Fundrise are both great platforms for investing passively in crowdfunded real estate. I’ve invested in both and have been happy with the results, so will continue to do so.

Which one you pick comes down to your investment objectives, and in some cases it may be wise to invest in both!

In my opinion, Groundfloor has an edge if you:

- Want to get started with a very small amount of money (as little as $10)

- Have a shorter time horizon for your investment dollars

- Want more control over your individual investments

And Fundrise gets the win if you:

- Want more diversification into larger commercial real estate deals

- Are looking for somewhere to invest long term (5+ years)

- Want a truly set-it-and-forget-it passive income stream

If you’re just getting started investing, or are looking to put money into more passive real estate investments, both Groundfloor and Fundrise are great options. Here’s the full summary of Groundfloor vs. Fundrise:

While that is certainly no guarantee of future results, I do think that real estate is one of the safer ways to invest in debt because you have a hard asset behind the loan (unlike with peer to peer lending where the only thing you have is a credit score and a promise to pay).

Pros:

- Start investing with as little as $10!

- Debt investment secured by underlying real estate

- Can invest in individual loans based on risk tolerance

Cons:

- Only offers debt investments (not equity)

- Requires a bit more maintenance to pick individual loans to invest in

Our own personal Fundrise portfolio is highly diversified across equity and debt deals, and in different geographic locations. I like that Fundrise gives you details on all of the individual properties you are invested in through the fund.

Pros:

- Start investing with as little as $500!

- Diversified fund of commercial real estate debt and equity

- Can choose your portfolio allocation based on your goals of income vs. growth

Cons:

- Higher minimum than Groundfloor

- Requires a long term investment horizon (3+ years)

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.