In this article, you’re going to learn how ARK Invest makes money. You’ll see the strategies they’ve been using to find their success in recent years. You’ll also get to know the vision and mindset of the CEO behind this company. Finally, we’ll show what you should do if you’re interested in investing. So, how does ARK Invest make money?

ARK Investment Management LLC is a federally registered investment adviser with total assets under management of $11.45 billion in 2020. Like other hedge funds, ARK Invest makes money by charging a management fee, of 0,75%, on each of their several actively managed ETFs. Their strategy is based on identifying disruptive innovation opportunities.

A little about ARK Invest

ARK Investment Management is a privately-held asset manager founded just six years ago that serves clients in the US. Their services include portfolio management, financial planning, and advisory services.

ARK Investment launched the first actively managed ETF in 2014. After crossing $5 billion in assets in June 2018, the firm manages nearly $19 billion, at the time of this article.

Rooted in almost 40 years of experience, ARK Invest aims to identify large-scale investment opportunities. These opportunities are mostly related to technological advances. In general, ARK Invest focuses solely on offering investment solutions that capture disruptive innovation in the public markets.

ARK has an open research approach that adds technology concepts and external inputs to traditional financial research. In like manner, they are able to create a more transparent and interdisciplinary investment process.

ARK’s founder and CEO Cathie Wood is a big factor behind this company’s success. In fact, her strategies and visions are becoming more and more famous as ARK Investment gains notoriety.

Cathie Wood

Cathie Wood founded ARK Investment back in January 2014. Prior to ARK, Cathie spent twelve years at AllianceBernstein as Chief Investment Officer of Global Thematic Strategies. There, she was in charge of investments that amounted to $5 billion.

Cathie started her career in Los Angeles, California at The Capital Group as an Assistant Economist. She received her Bachelor of Science, summa cum laude, in Finance and Economics from the University of Southern California in 1981.

Her track record speaks for itself. However, that’s not the reason she is making headlines in newspapers. Cathie is becoming famous for her innovation, especially in the investment market.

In fact, at ARK meetings, stock prices are not discussed. The focus is always on innovation. Finding big ideas. They are exclusively focused on the future, or “disruptive innovation.”

ARK’s Investment Process

In November 2020, Ark’s flagship fund, ARKK, had a return of 83.7% on the year, compared to 14.5% for the S&P 500. Since 2014, their return has beaten the index funds. Consequently, this is definitely not a fluke.

As a matter of fact, Cathie Wood’s strategy completely rejects the use of indexes. In her opinion, indexes are too passive and have become outdated. It totally ignores the innovation factor: where the true opportunities sit (in her words).

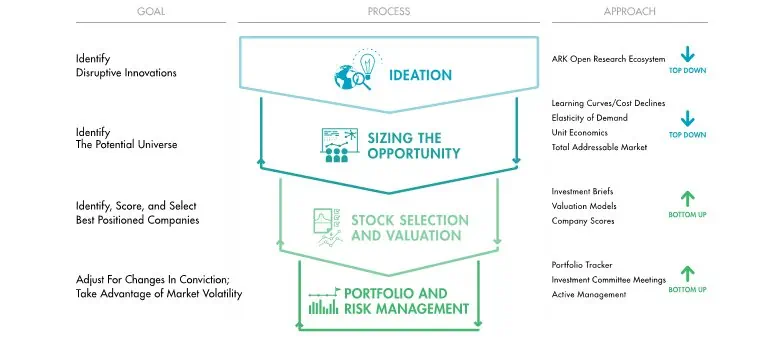

ARK Invest makes money through a very specific process. The success of their strategy relies on thorough research: top-down research and bottom-up research.

Top-Down Research

ARK’s research and investment team initially examine from the top-down how the world is changing and where it is headed. Coupled with an open research ecosystem to gather information, ARK is able to quickly understand changing innovation themes happening in the world.

With that information, they are able to best define and refine their internal research process. Inputs include theme developers who are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to ARK’s public research.

As a result of this research, ARK Invest anticipates and quantifies multi-year value-chain transformations and market opportunities. Next, they model cost-curves and calculate the elasticity of demand to identify entry points for technology-enabled disruption. Through this process, specific companies rise to the top as best positioned to benefit. At this point, they begin their bottom-up process.

Bottom-Up Research

ARK’s bottom-up analysis begins with a distilled group of potential investments, not a benchmark. ARK evaluates potential investments based on key metrics to quantify the companies in context of the opportunity. This includes building out a valuation and revenue model for each company in the portfolio over the next five years.

These models incorporate the company’s unit volume growth, cost declines, and market adoption and penetration. They also take into account important factors like share count growth and future multiples. Finally, as the CIO and Portfolio Manager, Cathie Wood has the final accountability for the selection of investments and approval for all investment decisions.

ARK monitors the underlying investment thesis of every company during weekly portfolio and research meetings. Generally, ARK will trim or add to positions to, among other things:

- Take advantage of opportunities created by short-term negative market actions or market sentiment;

- Provide liquidity to invest in companies in which ARK has relatively more confidence;

- Fund names that ARK believes offer relatively more market opportunity relative to the current price.

ARK may sell a company if their investment thesis changes. They also sell if their metrics don’t support a certain position size, or if they believe a company is no longer on the leading edge of innovation.

The 5 Buckets

ARK Invest makes money by investing heavily in 5 buckets: DNA sequencing, energy storage, robotics, artificial intelligence, and blockchain.

Not only will innovation stimulate substantial growth and create new markets, but they believe it also will disrupt sectors that historically have stoked high inflation. ARK Invest claims that global oil demand is likely to peak within the next few years as electric vehicles begin to scale and as autonomous electric taxi networks account for an increasing share of miles traveled.

Also, DNA sequencing will introduce science to health care decision-making in a way never before possible. Therefore, guesswork and waste will be gradually eliminated. At the same time, robots will serve not only as an antidote to labor shortages that are cropping up in the US, Japan, and elsewhere but also should increase productivity. This is one of the most powerful forces against inflation.ARK utilizes thematic investing to capture disruptive innovation.

Tesla Case Study

Tesla is a great example. While Musk’s company only cracked the S&P 500 in December 2020, it has constituted 10% of ARK’s fund for a long time. Cathie Wood always believed in the value of Tesla stock.

Another strategy often used is coupling deep research with social media. In fact, ARK’s investors heavily rely on connections through social media to gain deep insights into the companies in question. The lithium batteries market is the best example.

ARK research indicates the decline of electric batteries – and the possibility of a self-driving taxi service – is the key to Tesla’s growth. Therefore, they got in touch with a professor from Carnegie Mellon University in Pittsburgh, Venkat Viswanathan. The goal: to learn from the experts.

How does ARK Invest makes money

Like other hedge funds, ARK Invest makes money by charging a management fee on each of their ETFs. The annual expense ratio (or management fee) of each of ARK’s actively managed ETFs is 0.75%.

ARK Invest offers several managed ETFs that focus on disruptive innovation. There is a focus on the four best performing ETFs available on the market at the time of this article. Learn how to buy and sell ARK Invest ETFs. Let’s take a closer look at each one of them.

ARK Genomic Revolution Multi-Sector ETF (ARKG)

This investment focuses on companies that “substantially benefit from extending and enhancing the quality of human and other life by incorporating technological advancements in genomics into their business.” These companies will probably be investing their resources in Targeted Therapeutics, Bioinformatics, Molecular Diagnostics, Stem Cells, and other areas of interest.

ARK Industrial Innovation ETF (ARKQ)

This investment focuses on companies that are investing in “the development of new products or services, technological improvements, and advancements in scientific research”. Areas of interest in this sector go from Autonomous Transportation, Robotics to 3D Printing, Energy Storage, and Space Exploration.

ARK Web x.0 ETF (ARKW)

This investment focuses on companies that are currently “shifting the bases of technology infrastructure to the cloud, enabling mobile, and new and local services. For example, companies that rely on or benefit from the increased use of shared technology, internet-based products and services, and new payment methods.”

Areas of interest for these companies may include Cloud Computing & Cyber Security, E-Commerce, Big Data & Artificial Intelligence (AI), Mobile Technology and Internet of Things, Social Platforms, and Blockchain.

ARK Innovation ETF (ARKK)

This investment seems to be more generalized. It focuses on companies “that rely on or benefit from the development of new products or services, technological improvements, and advancements in scientific research. Also, the increased use of shared technology, infrastructure, the Next Generation Internet, and technologies that make financial services more efficient.”

Disruptive Innovation

ARK defines disruptive innovation as the introduction of a technologically enabled product or service that changes an industry. The product or service is normally known for creating simplicity and accessibility while driving down costs. Innovation enables industry growth, facilitates convergence across different sectors of the economy, and drives long-term investment opportunities.

Over time, innovation should displace industry incumbents, increase efficiencies, and gain majority market share. For that reason, ARK focuses on innovations centered around the 5 buckets, which they believe are converging to change the way the world works.

Importance of Innovation

It’s a very known fact that technology is disrupting our world at an accelerated rate. Multiple innovation platforms are enabling industrial growth and facilitating convergence across multiple sectors of the economy and industries.

The full magnitude of these innovations and the investment opportunities they create are often unrecognized or misunderstood by traditional investors. More importantly, disruptive innovation impacts all our lives and changes the way the world works for the better. Changes that go from communication and transportation to education and healthcare. To identify disruptive technology, ARK Invest relies on something called thematic investing.

Thematic Investing

ARK utilizes thematic investing to capture disruptive innovation. Thematic investing seeks to capitalize on long-term trends that cut across economic sectors and geographic boundaries. ARK believes thematic strategies can better adjust for rapid change. It also allows a deep understanding of the underlying drivers of long-term value creation and risk.

ARK Invest researches across sectors, industries, and markets to gain a deeper understanding of the convergence and market potential of disruptive innovations. That way, they’re able to size the investment opportunities more appropriately.

Benefits & Goals

Thematic investing can offer a low correlation of relative returns to traditional growth strategies. It also offers a negative correlation of relative returns to traditional value strategies, giving diversification for investors.

While benchmarks reflect past successes, thematic investing seeks to capture future growth. With this, investors are able to earn a market premium. A constant focus on secular changes and disruptive innovation can offer a portfolio hedge in a rapidly changing world and complement traditional index-based strategies. ARK Invest still uses benchmarks, but in a different way.

Benchmarks in ARK Invest

ARK manages its strategies in a benchmark agnostic manner. Despite this, ARK often illustrates the performance of its portfolios relative to broad market indices, including the S&P 500 Index, Russell 3000 Growth Index, and the MSCI World Index.

Most of the names in ARK’s portfolio are either not part of broad-based indices or represent very small weights. ARK believes the companies it invests in will be prominent in such indices over a full market cycle. However, this only applies to ARK’s actively managed ETFs.

Making Money With ARK Invest

You know how ARK Invest makes money. Now, make a decision whether or not you want to invest. Make sure you’re aware that all investment decisions are your responsibility alone. You should always be investing in a thorough and careful manner.

In terms of performance, ARKW is the best choice between the four. It’s also the least pricey. Always have in mind the market these options are in as well.

If you’re interested in know more, check out their website. See their options and decide what you want to do. More importantly, make sure you learn how to buy & sell Ark Invest ETF if you’re not familiar with it. Happy investments!