Everyone should be investing in some capacity if they can. Whether it’s through a 401(k), a Roth IRA, or just a personal brokerage account, investing is one of the best things you can do for yourself! And if all those fancy numbers and abbreviations (looking at you, Roth IRA) mean nothing to you, don’t worry, we’re breaking down how anyone can get started in this index investing for beginners (with little money) guide.

Before we get started, imagine this for a second… Let’s say when you were born you put $100 in your piggy bank. And every year for your birthday, you were fortunate enough to add $100 to that piggy bank (or your parents added it for you). When you turned 18 and went to withdraw that money, instead of it being $1,800, it was $3,700. Over double the amount you expected!

Magic! Right? Nope, that is the power of investing in the stock market which has historically provided 7% returns every year.

So now you’re 18, or 25, or 35, or 55, or however old you are today, and you want to set yourself up for a better future. Good! It’s never too late to start, and starting now is better than starting tomorrow.

Even if you’re starting from nothing or want to know how to invest only $1000, I promise you can get started today!

So let’s start at the beginning.

Why Investing Works

Magic piggy bank examples aside, investing just works. And it works for one simple reason: compounding returns. Compounding returns is actually a very simple topic, and it explains why the $100 a year turned into over double what someone would have expected. Here’s how it works:

If you invest $100 in the stock market and it returns 7% per year. After the first year, you will end with $107 in your account. Nice! A growth of $7.00 ($100 x 7%). What’s even better is that in year 2, your money will grow by more than $7! Now you have $107 starting the year. So the 7% growth on this slightly higher base of money will lead to gains of about $7.50.

Now you are ending the year at $114.50. And the year after that you will end with $122.50 (+$8.01). And the year after that you will end with $131.08 (+$8.58)

And so on. And so on.

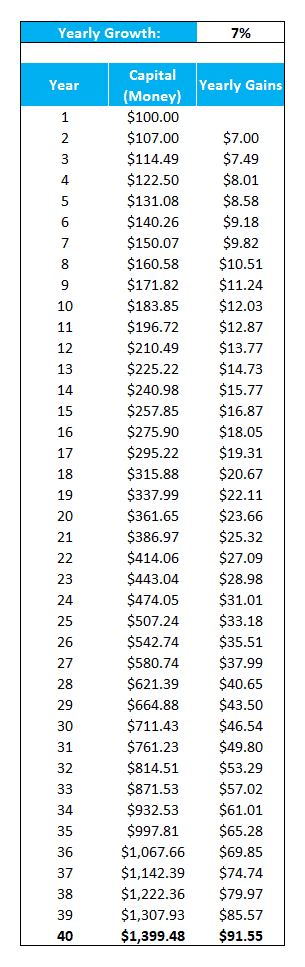

Here is a table to help bring this to life. At the end of a 40 year time period, your $100 would have grown to $1399.48!

Not only that but by year 40 you are making over $91 per year. On an investment that started at only $100!

Now let’s add some fuel to the fire.

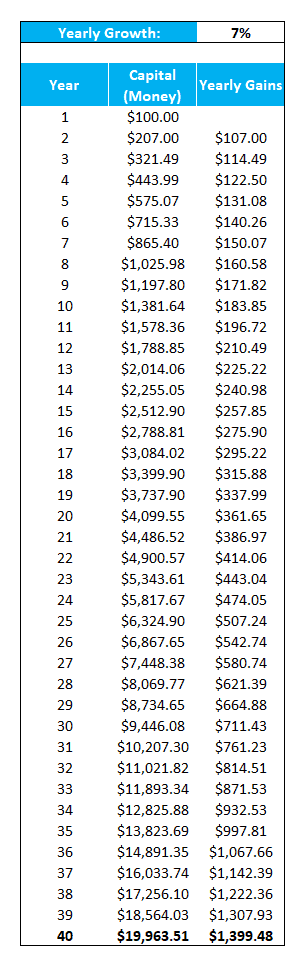

Let’s say you didn’t just invest $100 in year 1, but you added $100 every year after that as well. What would your total capital look like in year 40 if that was the case?

Let’s see:

Your eyes are not deceiving you, that is almost $20,000.

Investing $100 per year will net you almost $20,000 at the end of 40 years (+$16,000!). That is the power of investing. And that is why everyone should be investing today!

Investing Basics Everyone Should Know

What’s that? You’re sold on investing? Do you want to start now?!

Great to hear it.

Let’s just slow down for one second though, and get up to speed on some investing basics. Including the common questions:

- What can I invest in?

- Where do I invest?

What Can A Beginner Investor with Little Money Buy?

All of the examples above have been assuming that you invest in stocks or equities. Past data shows that on average, they usually return about +7% a year. But that is no guarantee.

In fact some years they could drop by 30%. And other years rise by 30%. They are extremely volatile investments.

And they are not your only investment option. There are four major asset classes you can choose from when investing:

- Stocks / equity: Pieces of individual companies that you can buy.

- Bonds: A loan that you issue to a company or government that collects interest.

- Real Estate: Physical property (you can even invest in real estate with only a little money, too!).

- Cash: Cash on hand or in a bank account.

Generally speaking, most investors focus on a portfolio of stocks and fixed income.

Fixed income encompasses both bonds and real estate because both provide fixed income payments (usually monthly). They are generally viewed as safer and less volatile investments than stocks. But also do not provide as good of returns on average (as the typical 7% stock returns).

To buy any of these asset classes, you do so by investing in investment vehicles. They include:

- Individual Stocks: Pieces of individual companies that you can buy.

- Mutual Funds: A group of assets (typically stocks, but can be bonds and other assets) that you can purchase by pooling money with other investors.

- ETFs / Index Funds: Similar to mutual funds, but typically match an index or sector.

- Bonds: A loan that you issue to a company or government that collects interest.

Obviously, as you can see, asset classes and investment vehicles overlap. Later in the post, we’ll dive deeper into how to invest in my favorite investment vehicles: index funds and ETFs.

Where Can You Buy It?

To buy any of the asset classes above and start investing, you first need to open an investment account. There are a few basic types of investment accounts that beginners can open:

- Individual Brokerage Account: A flexible account with no tax advantages.

- IRA (Traditional or Roth): A tax-advantaged retirement account.

- 401(k): A corporate-sponsored account that takes money from your paycheck before taxes.

You can learn more about the pros and cons of these account types here.

IRAs and 401(k)’s both have contribution limits set by the government since they are tax-advantaged (though the Backdoor Roth is one way to get around the Roth IRA limit if your income is too high).

To open one of these accounts, you typically need to go through a broker.

Online brokers are the popular options these days. Companies like Charles Schwab and Vanguard are great firms to open a brokerage account through, and either one provides brokerage accounts and IRAs for customers to open

You could also consider robo-advisors, which are also a form of online brokers. But more on that later. I want to get to the good stuff…

…index investing.

What is Index Investing?

Index investing is the process of investing in index funds. And, not surprisingly, an index fund is the combination of an index and a mutual fund.

Let’s break both down quickly: indexes and mutual funds.

An index, simply stated, is a measure of something. In the financial world, an index is used to measure a group of stocks or bonds. For example, the S&P 500 or the Dow Jones Industrial Average are both indexes

A mutual fund is an investment vehicle that pools multiple investors’ money together in order to put together a larger, more diversified group of assets

For example, let’s say you want to invest $1,000 in equities by purchasing a selection of stocks. You wouldn’t want to pick just one stock, because it could go bankrupt and fail and then you would be out of all your money. Even though there is an upside, it’s just too risky.

So you pick a few stocks to diversify your investments.

With your $1,000, you could buy 5 stocks and invest $200 in each. Or 10 stocks by investing $100 in each. Or 100 stocks by investing $10 in each.

The problem is, buying 100 stocks is complicated and time-consuming. Not to mention it can be costly, especially if your are investing small sums of money.

Transaction fees to buy 100 stocks could be upwards of $500! Plus, you might not be able to afford all the stocks you want to buy – one share of Amazon is currently at about $1,800!

This is where mutual funds come in. Mutual funds collect money from a bunch of investors and then spread the collective funds over a group of stocks. So you can invest your $1,000 in one mutual fund (with many other investors also putting in money) and get the diversification of the entire fund.

An index fund combines the two concepts: indexes and mutual funds.

Putting it Together

An index fund is a mutual fund, except instead of having a manager pick stocks to invest the collective funds in, the funds are invested in an index.

If Amazon makes up 3% of the S&P 500, 3% of the funds go into Amazon (with an S&P 500 index fund). A money manager does not get to put 10% in Amazon because he or she has a hunch. The index fund mirrors the index – no exceptions.

Why Index Investing is So Great for Beginners

Index investing is great for beginners for countless reasons, but below are the top 4 in my book:

1. It’s Easy

Investing in index funds is simple and extremely hard to mess up, which makes it great for beginners.Once you buy a few one (or even just one) index fund, you can “set it and forget it”… for the most part. Many index investors will check in just once a year to rebalance and make sure everything is still on track (no including adding money to invest on a regular basis).

2. You Get Broad Diversification

As already described, with an index fund you get broad diversification with just one purchase. There is no need to buy a huge number of individual stocks because your one index fund did that for you!

3. It’s Extremely Affordable

Index funds are affordable for a few reasons, but mainly because they have low expense ratios. We’ll focus on comparing costs to classic mutual funds since that is the index fund’s “main competitor” so to speak.

Expense ratios are what mutual funds and index funds charge per year to use their fund. Some mutual funds charge 1% per year or higher! So if you have a portfolio of $100,000, that means you have to pay $1,000 per year!

Most index funds are in the 0.05% – 0.25% expense ratio range. With some even boasting 0% expense ratios!

You also don’t have to have a ton of money to invest in index funds. Index investing for beginners with only a little money is a perfect option, because you can buy an index fund or ETF in most cases with less than $100!

4. The Strategy is Proven

Last, but certainly not least, the index investing strategy has been proven to work over the years.

The S&P 500 (an oft-cited index) has historically returned +7% annually. $10,000 invested today would be worth $138,426 in 40 years at that rate (also assuming a 0.03% expense ratio). Not bad.

An actively managed mutual fund would not only have to beat the +7% benchmark, but also has to beat it enough to cover its annual fees (which, as mentioned, can be as much as 1%, or higher).

If the actively managed fund doesn’t beat the benchmark and grows at the same +7% rate (with the 1% fee), it only grows to $97,035 over a 40 year period. That’s over $40,000 less than the index fund!

How You Can Start Index Investing Today

There are 5 simple steps to take to start index investing today. We’ll walk through them briefly below, and you grab a more detailed (but not too detailed) guide here if you’re interested.

1. Decide on the Right Investment Account

The first step to index investing is deciding where you want to invest. Remember, you have 3 basic options to choose from:

- Individual Brokerage Account: A flexible account with no tax advantages.

- IRA (Traditional or Roth): A tax-advantaged retirement account.

- 401(k): A corporate-sponsored account that takes money from your paycheck before taxes.

If you’re in the workforce, the bottom two (the tax-advantaged accounts) are usually a good place to start. Otherwise, a personal brokerage account is available to just about anyone over the age of 18. If you’re investing in a 401(k), make sure to avoid these 401(k) mistakes.

2. Select an Online Broker

The second step is part two to the “where should I invest?” question. This part involves choosing the right online broker to open an account with (step 1) and invest money through (parts 3-4).

In general, there are two types of online brokers to choose from: traditional brokers and robo-advisors.

Traditional online brokers include Charles Schwab and Vanguard. They give you more control over how to invest your money but require a little more work and oversight. And with the index investing strategy, I want to stress the word little in “a little more work”.

Robo-advisors are an up and coming online platform that do 99% of the work for you. In most cases, you complete a simple survey before opening an account with them and then the robo-advisor will invest on your behalf based on your answers. Usually, taking into account your age, retirement/investing goal, and appetite for risk.

Robo-advisors are great, new tools. But be warned, they usually charge a slightly higher fee (that they try to win back for you through tax loss harvesting).

3. Determine Your Initial Deposit

The first step in determining your initial deposit is figuring out how much you need to invest to reach your goals.

The initial deposit can be small, what’s even more important is making sure that you have the right ongoing plan and reinvestment schedule.

4. Choose Your Blend of Investment Vehicles

We walked through earlier your options for “what you can buy,” and now it’s time to decide! Finding the right blend of investment vehicles is never easy as everyone has individual needs. A rule of thumb I once heard was to invest your age in bonds and the rest in stocks. So, if you’re 25, you’ll be 75% in stocks and 25% in bonds.

It’s not a bad rule of thumb, but for me personally, it was not aggressive enough. Which is why you need to examine where you are and make a decision based on that.

If you need some help getting started, looking at a 3 Fund Portfolio may be a good place to start.

5. Set an Ongoing Strategy and Maintenance Plan

And last but certainly not least, you need to set an ongoing maintenance plan. This should likely include two things:

- Investing money monthly or quarterly as your saving plan allows

- Rebalancing your portfolio annually to make sure you are still on track for your goals

Index Investing for Beginners With Little Money – The Final Word

And that’s it!

Get started today and start setting your future self up for success!

This post originally appeared on The Money Mix and has been republished with Permission.

Kevin runs the personal finance website Just Start Investing, where he focuses on making investing easy. Just Start Investing has been featured on US News & World Report and Chime Bank, among other major publications for his easy-to-follow writing. Check out Just Start Investing to learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking and budget.