If you have many different debts with different interest rates, payoff schedules, and balances, it may sound like a good idea to sign up for debt consolidation. Debt consolidation can seem appealing with the promise of a significantly lower monthly payment and a reduced interest rate.

For some people, debt consolidation may be a reasonable solution. For others, they will be making the debt consolidation company rich.

The truth is, debt consolidation and debt relief salesmen will tell you whatever you want to hear to get your business. Don’t fall for any of the gimmicks or false promises. Before you sign on the dotted line, learn the truth about debt consolidation to find out if this strategy is right for your situation.

What Is Debt Consolidation?

Debt consolidation is the process of combining all of your debts into one single debt. If you have different loans out with varying rates of interest, the consolidation will give you one interest rate and one lender. This can often result in a lower interest rate and a single payment each month. By combining all of your debts into a single loan, it can be easier to keep track of your payment schedule.

Debt consolidation can combine auto loans, high-interest credit card balances, student loan debt, and medical bills separately or all together. This is accomplished by taking out a new loan or combining debt onto one credit card that will take over all the existing loans.

How Does Debt Consolidation Work?

If you find yourself with payday loans that are spiraling out of control in conjunction with your vehicle loan and high-interest credit card balances, it may seem like a good idea to apply for debt consolidation.

Debt consolidation can stop the ballooning interest rates and fees of a payday loan. Debt consolidation does this by paying off your balance in full with another loan and restructures your debt that you will repay to another lender.

While this may seem like a great idea, there are some additional facts you need to know about debt consolidation that we will discuss further in this article. Debt consolidation will often add fees and other taxes onto your existing balance and will also add more time to your debt payoff.

Ways To Get A Debt Consolidation Loan

There are several methods to consolidate your debt. All of the ways to secure a debt consolidation loan depend heavily on your current credit score.

Zero Percent (0%) Interest Cards

Depending on your outstanding debt, you may be able to transfer all of your outstanding debt to a 0% interest credit card if the card limit is high enough. Some people will transfer their outstanding debts to several 0% interest credit cards and play the shuffle game as they slowly pay off their debt on each card.

Keep in mind, most 0% credit cards have a transfer fee for moving outstanding debt onto the card. Also, 0% credit cards have a time limit to when the 0% expires, and the regular interest rate kicks in.

After the 0% interest time frame, your interest rate could jump to over 20% if you are not able to pay the card off in time.

You should avoid this dangerous game.

Private Loan To Consolidate Debt

Another method to utilize debt consolidation is to contact a lender, usually a bank, and request a private loan. This loan would cover all of the outstanding balances of the debt you would like to consolidate/combine. You would use the loan to pay off all the debts and make one single payment to your lender.

This is generally one of the best options to consider as long as you utilize a fixed rate interest loan.

Debt Consolidation Companies

Many debt consolidation companies will handle all of the paperwork, refinancing, and debt payoffs for you as well. These companies will charge a fee that often gets rolled into the loan they provide.

Home Equity Line Of Credit (HELOC) Loan

Another strategy is to utilize your home as equity and combine your debt into a home equity loan (HELOC). This process will also add additional fees to the loan and will extend the amount of time it will take to pay off your mortgage.

For instance, if you added $50,000 in outstanding debt to your home loan, depending on your loan structure, you may have just signed up to pay off the additional amount over 30 years. Even with a lower interest rate, the added time will usually end up in you paying much more than you would have if you would have paid the debt off using a snowball or avalanche method.

401k, 403b, 457 Loans – Borrowing From Your Retirement Plan

Depending on your current retirement plan, you may be able to take a loan from your 401k, 403b, or 457 retirement plan. These plans have strict rules as to the amount you can borrow and generally allow you to take a loan out up to $50,000 or half of your total retirement portfolio, whichever is less. For a detailed explanation of whether you should consider this option, refer to my related article, Is It Smart To Borrow From My 401k To Pay Off Debt?

Does Debt Consolidation Work?

Several people have asked me if debt and credit consolidation works. This is a generic question that requires much more insight and explanation to answer. For this broad question, the simple answer is, “yes,” debt consolidation does work to combine all of your outstanding debts into one simple loan.

This single loan may often have a lower interest rate and can lower your monthly payment. However, debt consolidation may cost you more money in the long run, depending on your situation.

Debt consolidation does not guarantee that it will save you any money even though you may have a lower interest rate and lower payment.

Debt Consolidation Example Scenario

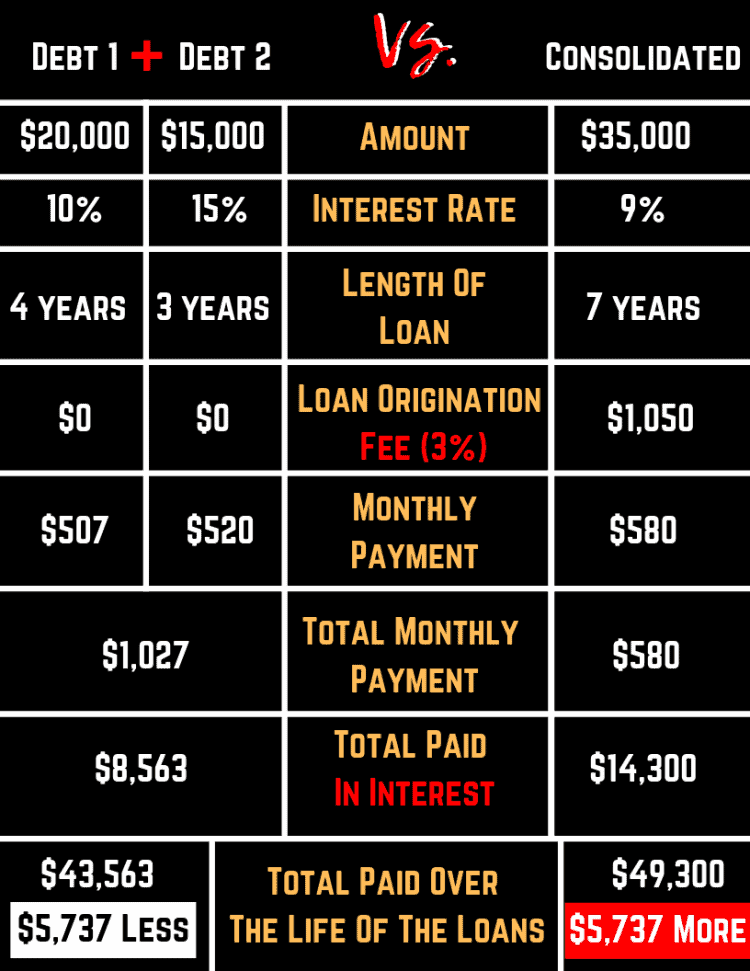

Below is a graph of debt consolidation scenario for someone who wanted to consolidate $35,000 worth of debt. I used the debt payoff calculator on Credit Karma for these numbers.

As you can see from the graphic, even with a lower interest rate, the added time and the origination fees can add up quickly. Time is not on your side when it comes to paying off debt.

Besides, if you plan on paying off the consolidated debt faster, some loans have prepayment penalties.

That means, if you want to pay off the principal by making larger monthly payments, you will incur additional fees.

Always read the fine print!

What Is The Average Debt Consolidation Interest Rate?

ValuePenguin did a study on debt consolidation interest rates and found that the rates vary significantly. The rate depends heavily on credit score but also differs by company. Here is the data they found:

FICO Score

- Excellent (720-850)

- Good (680-719)

- Average Or Fair (640-679)

- Poor (300-639)

Average Interest Rate

- 4.52% – 20.57%

- 6.67% – 28.33%

- 7.05% – 30.32%

- 15.06% – 36.00%

How Debt Consolidation Impacts Your Credit Score

Debt consolidation can impact your credit score in several different ways. Throughout the process, your score can change for the better or, the worse, depending on your circumstances.

Ways Debt Consolidation Can Hurt Your Credit Score

- When you initially apply for new credit cards or personal loans (to include a HELOC), your credit score will drop until you start making payments to the new lender.

- Your credit score will suffer if you continue to accumulate more debt after you have consolidated.

- If you apply for a personal loan or with a debt consolidation company for relief and you get denied, your credit score will take a hit.

- After you have obtained a debt consolidation loan or contract, if you are late on these new payments, your score will be negatively impacted.

Ways Debt Consolidation Can Improve Your Credit Score / FICO Score

- After consolidation, if you make consistent and on-time payments, your credit score will improve. On-time payments and debt reduction is the fastest way to improve your credit score.

- According to National Debt Relief¹, if you can reduce your outstanding debts to less than 30% of your credit limit, your FICO score can significantly improve.

Debt Consolidation And Debt Settlement Programs Are Very Different

As we discussed earlier, debt consolidation moves all of your bills into one single payment and lender with a fixed interest rate. A debt settlement program relies on a company to work on your behalf to reduce your debt.

What Is Debt Settlement?

A debt settlement program involves a contract with a company that will negotiate with your lenders with the hope of reducing the amount of money you need to repay. These companies will charge you a fee for their services and take over your debt repayment.

Debt settlement companies advertise that they can quickly help you become debt-free and avoid bankruptcy by reducing debt so you can pay it off sooner. However, there are no guarantees debt settlement companies can lower your debt. The lenders are in charge and are not required to settle any of the liabilities for less than the full amount owed.

How Does Debt Settlement Work?

There are several strategies that debt settlement companies use to negotiate with debt collectors. Some methods utilized are:

- They may stop paying on your credit cards or loans to pressure the companies to settle your debt.

- Debt settlement involves contacting the lender in an attempt to negotiate a smaller balance. Debt settlement companies will do this on your behalf.

- If the debt settlement company is not successful in reducing the debt, as the borrower, you will be responsible for any late fees the lenders tacked on.

- Very few debt settlement companies can guarantee anything and are heavily governed by the Federal Trade Commission due to scams involved.

- Stopping payment on debt and incurring late fees will negatively impact your credit.

- If any of your debts are settled and reduced, this will be reflected on your credit report as settled, and any unpaid debt may show as settled.

In reality, debt settlement can be done by you without the help of a debt settlement company. For more information, check out my related article, How To Negotiate With Debt Collectors!

Due to the number of scams and lack of guarantees, you should avoid debt settlement programs and companies at all costs. Anything they offer, you can do on your own without paying them high fees and destroying your credit.

So, Is Debt Consolidation A Good Idea?

If you have mountains of debt with different interest rates and different lenders, you need to consider all the pros and cons of debt consolidation before you make a final decision.

Pros Of Debt Consolidation

- Debt consolidation can significantly lower the interest you are paying by moving the balance to a 0% interest card or a lower interest rate personal loan.

- Debt consolidation can help simplify your debt repayment by giving you one lender to pay rather than many different lenders each month.

- It can reduce your monthly payment on your total outstanding debt.

Cons Of Debt Consolidation

- Additional balance transfer fees will be added to your total amount of debt

- Debt consolidation can increase the amount of time it takes to get out of debt by adding additional years before you are required to pay off the loan.

- Your credit score (FICO score) can be hurt by applying for new loans.

- A lower interest rate with extended time to repay the debt can cost you more money in the long run than if you had paid the debt off without consolidating.

- If you have a spending and budgeting problem, debt consolidation will not help your underlying issue.

The Best Option If You Are Considering Debt Consolidation

Debt consolidation and debt settlement will come with additional fees and will often add a significant amount of time to your debt payoff plan. The lower payment and interest rate gives you the illusion of saving money, but in reality, you are adding more time and more money to your debt.

The immediate relief you receive from a lower payment can be quickly erased if you have not put a plan together to get out of debt and stay out of debt.

There are very few cases where hiring a debt consolidation service makes sense. If you have an incredibly high-interest rate, it may make mathematical sense to refinance if you commit to paying the same amount or more off each month. Lowering your payment will help you pay the loan off quicker by paying more than the required amount (if the loan does not have a prepayment penalty).

A Debt Management Plan

- Create a budget (consider Dave Ramsey’s recommended budget percentages)

- Build a savings account structure

- Start an emergency savings

- Pay off your debt with the debt snowball or the debt avalanche method

With patience, persistence, and by following the above plan and links, you will be able to get out of debt. The biggest challenge is maintaining discipline and a commitment to changing your lifestyle.

Bill consolidation or settlement is a “quick fix” that usually does not end well. These programs make other people money while giving you the illusion of saving money.

If you have an income problem, check out these great ways to make money from home.

Save money and time by getting out of debt the right way – through hard work, determination, and a plan.

Up Next:

See how two ordinary families paid off mountains of debt. Their stories are inspiring and will keep you motivated on your debt payoff journey!

- How Ashley Paid Off $45K of Debt in 18 Months!

- How a School Teacher Paid Off $34,000 in Less Than 3 Years

This article originally appeared on The Money Mix, and has been republished with permission.

As a full-time police officer and personal finance blogger, Ryan Luke has made it his personal mission to provide honest and easy to understand personal finance information. He is a husband and the father of three children. Through proper budgeting and money management, they have been able to live off one income and build wealth at the same time. Come join him in an active conversation about all the best personal finance information available at ArrestYourDebt.com!