Unless you’ve been living under a rock (which is probably a great place to be right now), you know that the current pandemic is causing unprecedented economic, and human, losses.

The U.S. government has been hard at work to try to protect the most vulnerable workers – those in the service industry, travel, or lower and middle class. The U.S. Senate and House have just passed the largest economic stimulus package in history, and it was signed by the President.

While the total stimulus package totals over $2 trillion, I want to focus on what is most likely to affect you – by putting extra cash in your pockets in a time of need.

How Much Will My Stimulus Check Be?

For those that are eligible, you will receive $1,200 per adult and $500 per child in your household.

The stimulus check eligibility will be determined based on your 2018 tax return. While the tax filing deadline for 2019 has been extended to July, if you’ve already filed your 2019 taxes, the amount you receive will be based on that.

Your total cash payment may be reduced or eliminated entirely depending on your income (see below).

Am I Eligible to Receive a Stimulus Check?

Eligibility is determined based on your income and tax filing status.

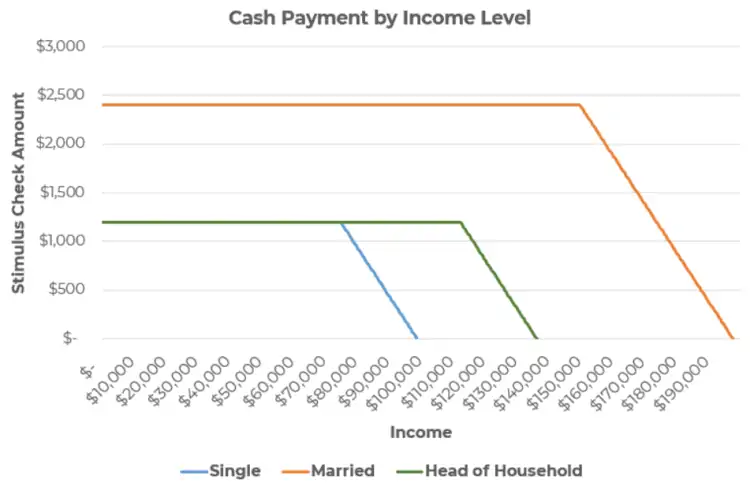

Individual Filing Single

If you are filing single and make less than $75,000 per year, you can expect to receive the full amount of the stimulus check ($1,200). In addition you will receive $500 per child under 17.

If you make more than $75,000 but less than $99,000, the amount of your payment will be scaled down as your income increases. If your income is above $99,000, you will not be eligible for a cash payment.

For those subject to the income phase out, for every $100 you earn above $75,000, your cash payment will be reduced by $5.

Example: If you are an individual making $80,000 per year, you can calculate your payment with the following steps.

- Subtract $75,000 from your income of $80,000 ($80,000 – $75,000 = $5,000)

- Payment is reduced by 5% of this amount ($5,000 x 0.05 = $250)

- Total cash payment is $1,200 minus your phase-out reduction ($1,200 – $250 = $950)

Once income hits $99,000 you hit the max phase-out reduction of $1,200, thus you receive a $0 payment.

Married Filing Jointly

If you are filing jointly with your spouse and your combined income is less than $150,000, you can expect to receive the full amount of the stimulus check ($1,200 each, $2,400 total). In addition you will receive $500 per child under 17 in your household.

If your total family income is more than $150,000 but less than $198,000, the amount of your payment will be scaled down. If your income is above $198,000 as a married couple, you will not be eligible for a cash payment.

As with individual tax filers, for every $100 you earn above the income threshold, your stimulus check is reduced by $5 (5% of income).

Example: If you are a married couple earning $175,000, you can calculate your payment with the following steps.

- Subtract $150,000 from your income of $175,000 ($175,000 – $150,000 = $25,000)

- Payment is reduced by 5% of this amount ($25,000 x 0.05 = $1,250)

- Total cash payment is $2,400 minus your phase-out reduction ($2,400 – $1,250 = $1,150)

Once income hits $198,000 you hit the max phase-out reduction of $2,400, thus you receive a $0 payment.

Filing Head of Household

If you are single or unmarried with dependents, you are probably filing as head of household. In that case, you will receive the full amount of stimulus if your income is less than $112,500. In addition you will receive $500 per child under 17 in your household.

The cash payment phases out between $112,500 and $146,500 following the same rules as those filing individually and jointly ($5 decrease for every $100 in income above $112,500).

Here’s a chart that shows the cash payment received based on income for each tax filing situation: single, married, and head of household.

Will I Receive $500 Per Child?

Yes, if you are married or single and have dependent children under the age of 17, you qualify to receive $500 per child.

The definition of who qualifies is the same as the qualifications for the Child Tax Credit.

There is no limit to how many children will qualify. If you have one child, you will receive $500. If you have eight children, you will receive $4,000!

A couple of things to note:

- To clarify, if your child is 17, they do not qualify (must be under 17).

- If you are above the income limits (whether filing single, married, or head of household), you would not be eligible to receive the $500 per child either.

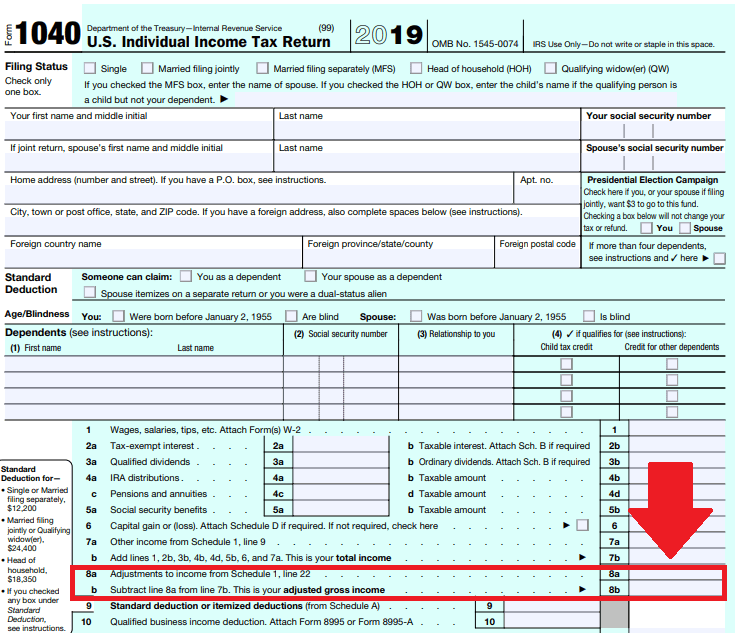

How Is My Income Determined?

The income used to calculate your stimulus check is your Adjusted Gross Income (AGI) from your 2018 income tax return (or 2019 if you have already filed).

Adjusted Gross Income is calculated when doing your taxes, and it may vary significantly from your paycheck. For example, if you have a side gig or real estate investments, you would include that as income, but then subtract out any pre-tax deductions such as 401k contributions and health insurance premiums.

You can see your exact AGI by looking at Line 8b on the Form 1040 of your tax return.

What If I Made Less Money in 2019 Than 2018?

If you are were above the income threshold on your 2018 return but you haven’t filed for 2019 yet and you made substantially less money, you might be worried you missed out on the stimulus check.

Well good news! The stimulus check is technically a credit on your 2020 tax return (the IRS loves technicalities).

So the final amount of your stimulus payment will be determined based on your 2020 income and reflected on your 2020 tax return in April 2021.

The checks being sent out now are basically an advance payment of this tax credit. So if you miss out on qualifying for the stimulus check based on your 2018 income, but you will qualify based on 2020 income, you will receive the money when you file your 2020 taxes.

Example: You made $100,000 in 2018, but your income was reduced to $60,000 in 2019. If you haven’t filed your 2019 taxes yet, you would not receive a stimulus check because your income in 2018 was too high. However, when you file your 2020 tax return, if your 2020 income was still under the threshold, you would receive a $1,200 tax credit at that time.

OK, So What If I Make More Money in 2020?

All this begs the question, what if you qualify for the stimulus check based on your 2018 income, but you end up being over the threshold based on your 2020 income?

The short answer is, it’s not 100% clear. But it appears from various sources I’ve read that you would not have to pay back the “tax credit advance” you are receiving now.

Will My Stimulus Check Be Counted as Taxable Income?

No, the stimulus check is not taxable income.

As stated above, it is technically an advance on a tax credit, and tax credits are not taxable (say that 3 times fast).

Do I Qualify If I am Retired and on Social Security?

Yes, even if you didn’t file a 2018 or 2019 return, if you are receiving social security, you will be eligible to receive the cash payment.

When Will I Receive My Stimulus Payment?

According to Treasury Secretary Steven Mnuchin, most people should receive their checks within 3 weeks.

If you are set up to get your tax refunds via electronic deposit, your stimulus payment will be direct deposited into your bank account. It may take longer if you get a regular paper check in the mail.

UPDATE: Based on a memo circulated through Congress, those who have direct deposit information on file will likely receive their payments the week of April 13th. The IRS will then begin issuing paper checks around the week of May 4th, and it could take several months before the last check is sent.

What If I Owe Back Taxes or Am Behind on Federal Student Loan Payments?

The stimulus bill specifically removes any of the usual offsets that would ordinarily reduce tax refunds. If you currently owe back taxes, student loan interest, or any other government debt, you will still receive the full amount of the cash stimulus payment.

The only exception is if you are overdue on child support payments, and the state has reported it to the Treasury Department. In this case, child support payments owed will be deducted from your stimulus check.

What If I Moved or My Bank Account Info Changed Recently?

The IRS will use the most up-to-date information it has to get the stimulus checks to you. If you’ve filed your 2019 return, the check will be mailed to the address on your return. If you receive your tax refund via direct deposit, you can expect to get your cash payment directly into your bank account.

However, if your address is not current (whether from your 2018 or 2019 tax return), you can fill out Form 8822 Change of Address to notify the IRS of your updated address. If your bank account information is out of date, there is currently no way to update that unless you plan to file a new tax return. If your direct deposit account is not active, the IRS will mail the check to your address instead.

UPDATE: Coming in mid-April, the IRS will allow you to check your payment status online, and also provide updated address or bank account information if needed.

What If I Haven’t Filed Taxes in 2018 or 2019?

In order to receive the stimulus check now, you will need to have filed 2018 or 2019 taxes. There is still time to file your tax return to be eligible for the stimulus checks.

If you don’t file for 2018 or 2019, but do file in 2020, you would receive the amount you would have gotten as a cash payment as a tax credit on your 2020 taxes.

One exception to this is if you are on Social Security retirement, disability (SSDI), or survivor benefits. If that is the case, you do not need to have filed a tax return and you will receive your payment the same way you get your Social Security benefits.

UPDATE: If you did not file a 2018 or 2019 tax return because your gross income was under $12,200 (or $24,400 for married couples), you can provide your information to the IRS online here to receive your stimulus payment without having to file a tax return! You can also use this portal to apply for the $500 dependent benefit.

Will There Be More Payments After This One?

Maybe. Depending on how long the economy is shut down, the President and Congress have not ruled out additional stimulus. But nothing is currently in the works.

Avoiding Stimulus Payment Scams

Unfortunately, there are already many scams out there that will try to steal your stimulus check or collect your personal information. Please be careful, and do not give out bank account or personal information if you are unsure of the recipient.

Per the IRS:

“The IRS urges taxpayers to be on the lookout for scam artists trying to use the economic impact payments as cover for schemes to steal personal information and money. Remember, the IRS will not call , text you, email you or contact you on social media asking for personal or bank account information – even related to the economic impact payments. Also, watch out for emails with attachments or links claiming to have special information about economic impact payments or refunds.”

What Other Stimulus Benefits Are Available?

While the main topic of discussion was the stimulus checks, there are some other major benefits for certain people (especially if you lost your job).

Extra $600 Per Week in Unemployment Benefits

If you lost your job (whether temporarily or permanently), you can apply for unemployment through your state. Generally unemployment is capped at $300-500 per week depending on the state.

The federal stimulus bill that just passed will add an extra $600 per week on top of your normal unemployment benefit for the next 4 months.

That is a huge increase, and could allow you to get $1,000 per week or more while unemployed. The stimulus bill also expanded who can file for unemployment to include contractors, gig-economy workers, and others who would not normally be eligible.

To see details for your state, try googling “Your State” unemployment benefits to see if you are eligible due to the current crisis.

Emergency Mortgage Forbearance

If you have a mortgage insured by the government (Fannie Mae, Freddie Mac, VA, HUD, or USDA), you can request a forbearance of up to 180 days from your mortgage company. You will need to provide details of any hardship related to COVID-19.

No additional fees, interest or penalties will be applied, but the payment is postponed, not forgiven. One possibility is that the missed payments will be added to the end of your mortgage term, extending it by however many months the loan was in forbearance.

Coronavirus Student Loan Stimulus

If you have federal student loans, your interest rate will be set to zero and the payments will be suspended through September 30th, 2020.

Note that your total amount due will not ultimately change, but the payments can be delayed without accruing additional interest.

How Else Can I Prepare for the Shutdown and Recession?

Obviously if you’ve lost some or all of your income, the stimulus check is meant to help cover the bills. But what else can you do? Here are a few tips for how to prepare for a recession.

Even if you don’t need the extra cash now, it would be wise to plan ahead for a potentially lengthy shutdown and recession. While there is hope the economy could resume within the next month or two, the only true “cure” for the Coronavirus is a vaccine. While experimental trials have already started, it could be at least 12 – 18 months before a vaccine is approved and ready for the public.

In a temporary cash flow crunch due to the Coronavirus shutdown?

Doing a balance transfer can help. Some benefits include:

- 0% APR interest during the introductory period

- Low balance transfer fees

- Consolidate multiple payments into one

As always, Wealthy Nickel does NOT recommend opening new credit cards if you plan to carry a balance past the introductory 0% interest period.

>>> Click Here to See the Best Balance Transfer Credit Cards <<<

So what can you do to be prepared?

- Follow CDC guidelines to stay safe. Protecting your family’s health is the first and foremost concern. While shutdowns and shelter-in-place orders can be inconvenient, they are mean to “flatten the curve” and reduce the number of people that get the virus to a level that is manageable by the healthcare system. Follow government guidelines to help slow the spread such as washing your hands often, avoiding touching your face, and practice social distancing.

- Add to your emergency fund. Now is the time to increase your emergency fund if you can. If you don’t have one, plan for contingencies such as taking out a HELOC (home equity line of credit) on your house or potentially tapping into a 401(k) loan if you absolutely must.

- Make a budget. If you haven’t already, starting a budget will allow you to see where your money is going and where you can tighten things up. You can use these budget percentages as a starting point. For an online solution, I use and recommend Personal Capital to track all of my finances in one place.

- Lower your expenses. By tracking your expenses for your budget, you can see where you can cut unnecessary costs or lower existing bills. Trim is an automated tool that will help you negotiate bills such as your cable or phone bill. And Gabi is a great tool to help you compare insurance rates and save you money on home and auto insurance.

- Make extra money on the side. If you have extra time on your hands during the shutdown, now is a great time to consider a side hustle, or find ways to make extra money. Even if you’re short on time, there are some ways to make money fast without too much effort.

Still Have Questions?

The IRS created a website where additional information will be posted on the stimulus as it becomes available. I will also be updating this page as more information is released.

In the meantime, feel free to post your question in the comments below and I will try to find the answer.

Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own family’s journey on his blog.

Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. He has worked as a financial analyst and accountant in many aspects of the financial world.

Andrew’s expert financial advice has been featured on CNBC, Entrepreneur, Fox News, GOBankingRates, MSN, and more.

How will we get the refund? Where will it come?

The IRS should use the information they have on file for you, either a bank account number if you receive your refund electronically, or your home address.

What if you owe the irs? Will it be offset?

No, you will still get the check, unless you owe back child support.

When my 2018 taxes were filled i had a checking account. I no longer have account. Does the check get mailed to my current address? I have different address since I filed. However my change of address was submitted last year.

If you submitted a change of address form to the IRS with your current address, you should be ok.

I currently have fell one month behind in child support due to my job being put on hold because of this virus will they take that one month and send me a check for what is left or will I just not get one at all

I believe how it reads currently, the back child support would be taken out of the stimulus check, and you would receive the rest.

Will you receive a stimulus check if you are on SSI

Yes, those on social security or SSI will receive a check.

Will the check go on the same card the ssi gets puts on

From what I have read, they are still working out the details on that (whether it will be mailed separately or go to your SSI card).

What if your over 17 and your mom carried you in her taxes, I’m 21 but I work and pay taxes

Unfortunately if you are claimed as a dependent on someone else’s taxes you will not receive a payment.

Will veterans receive a check if they didn’t have a regular income in the past 2 yrs.?

As long as you filed a 2018 or 2019 tax return, you should receive a check.

Question on Sick Pay and Family Leave bill – It seems to be effective April 2, 2020, what about all the people sick in February, March or even back in December?

I could not find any credible info one way or the other on this issue. You might contact your company’s HR department for details.

So the stimulus check that’s coming out those that make 75000 or more a year are the ones that’s going to get help what about us the ones that don’t make 75000 a year

You will receive a check if you make less than $75,000. The payment phases out if you make more than that.

What if you have no income and you’re 58, you get ebt, ” food stamps” and you’re homeless? You use someone’s phone number for messages and their address for your mail. Will I get a check? If so what do I do? Thank you in advance!

To receive a check, you must have filed a 2018 or 2019 tax return (even if you owed $0 or received a tax credit).

What if I have been unemployed for 3 years and have not filed any taxes. Will I get a check?

You need to have filed a 2018 or 2019 tax return or be on social security to be eligible. You can still file a 2019 tax return even if you have no income.

Does a person whose on disability and receives a disability check and was claimed as a dependant on another’s person’s taxes receive a stimulus check?

If you are claimed as a dependent on someone else’s taxes, you will not receive a check.

Okay what if your child was 15 when u filed in 2018 and now she 17 will she still be able to get it

It is not entirely clear, and I expect more details to be released, but it appears that it is based on their age when the tax return was filed.

What if I’ve moved and my bank account information is different than my 2018 tax return?

It appears there will be a website set up to collect current residence information if different from your tax return. See article here.

I understand people that owe child support don’t get this check but what if they have a dependent under 17? Do they at least get that?

It appears that any amount of back child support owed will be deducted from the stimulus checks, including the $500 per dependent. If total amount owed is less than your expected cash payment, you would receive the difference.

What about installment payments on IRS debt… will/ can that be postponed like student loans?

I do not believe installment payments on IRS debt will be postponed based on the current bill. However, being past due on an installment loan would not exclude you from receiving a stimulus check.

Do adults ages 18-23 years old receive a check? I have read conflicting statements about this!

As long as they meet the income requirements and filed a tax return (and weren’t claimed as a dependent on someone else’s taxes) they should get the money.

What if I havent worked or filed taxes??

If you have not filed taxes for 2018 or 2019, you will not receive a check. Even if you didn’t owe taxes, I would recommend filing a 2019 return so you will be eligible.

So my question is if you are not caring for the child you claim last year because you are no longer in their life Is it right for you to still get a stimulus check for them.. and as the parent now who is caring for them how do you stop that

If you will claim a dependent in 2020 that you didn’t claim on your previous tax return (either 2018 or 2019), you will not receive the $500 payment for that now, but you will when filing your 2020 tax return.

Will this come off of our next year taxes ?

It will be reported as a tax credit on your 2020 taxes when you file them. You do not have to pay it back.

My husband owes back child suppprt, but is making the monthly payment? He is on disability. Will this affect my stimulus check? Since we filed together. We also have 2 children if our own…

Child support owed would be deducted from the stimulus check and you would receive the difference.

What if you are owed back child support. Does the stimulus payment the parent that is behind on payments go to the parent that is owed back payments?

No you will not get their stimulus payment directly, but the back child support owed will be taken out of their check and used toward paying that down. It may take some additional time to receive that money.

What about single mothers, that stay home & take care of their children I haven’t work since 2005, I am a widow, no income!

Even if you have no income, you should be eligible if you filed a 2018 or 2019 tax return, or are on some form of social security.

what if you were claimed as a dependent on 2018 taxes but filed 2019 taxes on my own will I get a check

If you have filed 2019 taxes and are not claimed as a dependent on anyone else’s 2019 tax return, you should receive a check.

I owe taxes this year and I already filed, I also set up an account with the IRS to start making payments in the future, Will they be able to use my account that I have set up to make payments even though it isn’t in direct correlation with the filing of my taxes, or will I need to look out for this website that I can add my banking info? I did receive a refund last year,and the banking info is still the same. Thank you.

I’m not sure if they would use that account as it is not correlated to your tax filing (they might). I would recommend waiting for the website to be set up to double check if they have your info on file.

if your on social security disability,will the money go directly into your account or will you get a paper check?

From what I can tell, it should be paid to you via the same method you receive your social security payment.